Not only is it difficult to tell which currency might be a safe haven - i.e. will protect us from the rigours of this world. We don’t know what rigours await us. Not only the FX market but the financial markets in general seem to bet quite clearly on the optimistic side.

In the FX space, the USD is trading mostly lower again, with the NOK leading G10 FX gains, rising nearly 0.5% on the day (but well off the high); other commodity currencies appear more reticent,

We wish to initiate longs in NOK vs. 50:50 basket of GBP and CAD, our defensive global view has motivated near-term bearish bias on NOK thus far and has kept us from outright NOK longs despite a few positive developments. Domestic developments over the past month an upped fiscal response and a better-than-expected domestic growth outlook has been one factor that improved the near-term outlook for NOK.

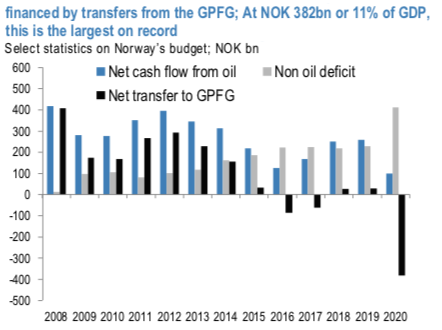

On the fiscal side, the revised Norwegian budget was larger than originally anticipated with a fiscal thrust of 5.1% of GDP, 0.5%pts larger than initial estimates making Norway’s fiscal response among the largest globally. The corollary of lower oil prices and the large fiscal response is that net oil revenues have plummeted by 60%, which necessitates that the bulk (80%) of the non-oil balance of be funded via the GPFG. This would be the largest use of the GPFG on record (refer 1st chart) and is relevant for the currency since it involves sales of FX to buy NOK. The estimated FX sales/ NOK purchases are in the ballpark of NOK 382bn or11% of 2020 GDP, which is 2.7x Norway’s current account surplus in 2019.

Moreover NOK valuations are cheap on a REER basis, second cheapest in G10 (refer 2nd chart). We pair this long vs. CAD and GBP for now given their idiosyncratic vulnerabilities (see discussion below), so while this is a relative value trade, it is nonetheless still dependent on global recovery given the higher beta for NOK. Hence, a rollover in activity data/ oil remains a risk.

Trading tips: Buy NOK vs. 50:50 basket of CAD and GBP, at an average spot rate of 9.524, and a separate stop. Courtesy: JPM

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios