EURCAD, on a broader perspective, has been drifting in the range between 1.5258 - 1.4442 from the last couple of months.

Last month, we witnessed stern bullish rallies but for now, the trend is foreseen to hover in the similar range, certainly not any dramatic spikes.

Refer below weblink for more reading on technical in our recent post:

Well, after glancing through one must be convinced with short-term downtrend and long-term non-directional trend remains intact.

Large options set to constrict today’s range.

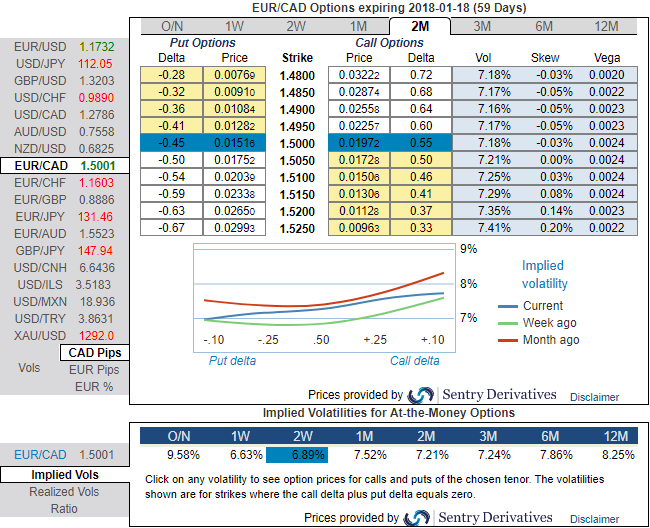

The EURCAD appreciation seems to be sluggish than it has recently been as the CAD likely to get cushion on crude price support, while the skew is still undecided whether volatility should rise on the back of a higher or lower spot (refer above nutshell evidencing positive IV skews stretched towards OTM calls for strikes upto 1.5250 but with lower IVs).

As such, we do not focus on intermediary vega gains to favor instead a buy-and-hold structure benefiting from the passage of time, as the IVs are very tepid (below 7%) and the timing of euro upside is less certain. It is wise to know that an option writer wants IV to shrink away so as to fall premiums. Please also be noted short-dated options are less sensitive to IV, while long-dated is more sensitive.

Well, contemplating the recent fundamentals, technical and OTC developments, we’ve devised options strategy for EURCAD on hedging grounds.

Trade execution: at spot reference: 1.4768, buy EURCAD 2m ladder, strikes 1.4721/spot (i.e. 1.5011)/1.5213 (we wouldn’t like to be precise about the indicative offer, certainly assured but slightly lower than vanilla structure).

Rationale: We’ve already stated that there has been a stiff tug of war between EURCAD bulls and bear in the recent past. Two short legs would reduce the cost of hedging, while ITM longs to mitigate upside risks.

Risks profile: See for the above structure exposes investors to maximum risks if the underlying EURCAD spot FX trades above upper BEP at the 2m expiry, a level not seen since last month.

Currency Strength Index: FxWirePro's hourly EUR spot index is inching towards -66 levels (which is bearish), while hourly CAD spot index was at shy above 13 (neutral) while articulating (at 07:16 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?