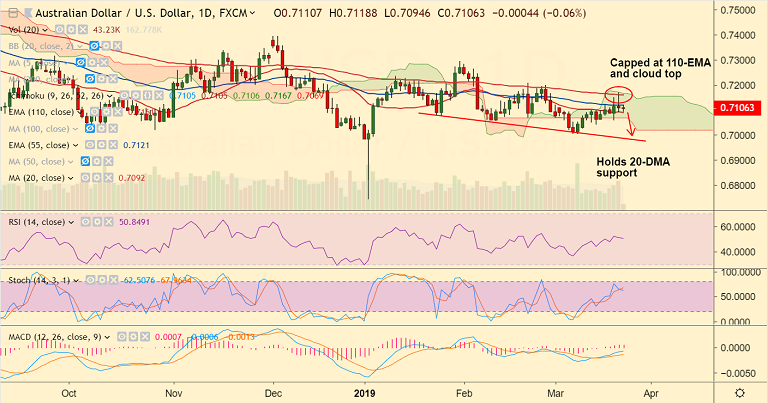

AUD/USD chart - Trading View

- AUD/USD is trading in a narrow range, trades at 0.7104 at 0500 GMT.

- Price action capped between 55-EMA and 20-DMA, breakout will provide a clear directional bias.

- Antipodeans subdued on renewed risk-aversion amid latest US-North Korea issue and China's temporary anti-dumping measures on some products from the European Union.

- Further, downbeat Aussie data weigh negatively. Australian flash manufacturing PMI dropped to 52.0 vs. 52.9 previous.

- Technical indicators are neutral on the daily charts, but major trend in the pair remains bearish.

- Break below 20-DMA could see resumption of weakness. Dip till 0.70 and then trendline support at 0.6985 likely.

- Decisive break above cloud and 110-EMA required for any meaningful gains.

- Focus now on US macro news due later on Friday, including Markit manufacturing and services PMI reports, existing home sales and wholesale inventories, for fresh trading impetus.

Support levels - 0.7092 (20-DMA), 0.7069 (cloud base), 0.70, 0.6985 (trendline)

Resistance levels - 0.7121 (55-EMA), 0.7161 (110-EMA), 0.7167 (cloud top)

For details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.