Today, a busy start to a busy week of data and events in Australia saw the release of news concerning business sentiment, Caixin manufacturing PMIs and on the prices of both general consumer purchases and homes.

Looking out over the remainder of the week, the key focus tomorrow will be on the outcome of the RBA’s latest Board meeting and the evening release of the Government’s pre-election federal budget. The RBA is widely expected to leave the cash rate at 1.5%, but there will be plenty of interest in the contents of the accompanying short statement in light of last week’s dovish turn by the RBNZ.

Given that the labor market remains firm – indeed with the unemployment rate reaching a new low of 4.9% in February – the RBA will most likely retain a largely neutral stance pending the release of the Q1 CPI later this month and a full economic update when the next Statement on Monetary Policy is released next month.

Aussie dollar has gained upside traction momentarily ahead of the above event. We will now quickly run you through OTC outlook of AUDUSD, before proceeding further into the options strategic framework.

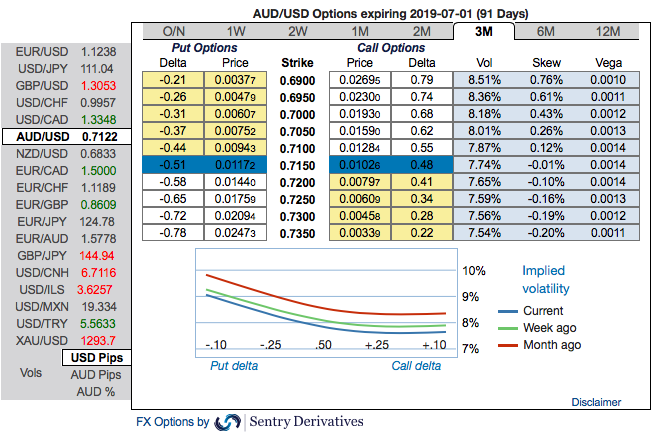

Please be noted that the positively skewed IVs of 3m tenors signify the hedgers’ interests to bid OTM put strikes up to 0.69 levels which are in line with the above bearish scenarios (refer 1stnutshell).

Please also be noted that mounting numbers of bearish risk reversals and bearish neutral RRs of the 3m tenors that are also in sync with the bearish scenarios refer to 2nd (RR) nutshell.

In a nutshell, AUD OTC hedgers’ sentiments substantiate that their risk mitigating activities for the downside risks have been clear.

Accordingly, diagonal put spreads are advocated to mitigate the downside risks with a reduced cost of trading.

The execution of options strategy: Short 1m (1%) OTM put option with positive theta (position seems good even if the underlying spot goes either sideways or spikes mildly), simultaneously, add long in 2 lots of delta long in 3m (1%) ITM -0.79 delta put options. A move towards the ATM territory increases the Vega, Gamma, and Delta which boosts premium.

The rationale: Contemplating all the above factors, we have advocated delta long puts for the long term on hedging grounds, comprising of more number of ITM long instruments and theta shorts with narrowed tenors for 1m shrinking IVs to optimize the strategy.

Theta shorts in OTM put option would go worthless and the premiums received from this leg would be sure profit. We would like to hold the same option strategy as stated above on hedging grounds. Thereby, deep in the money put option with a very strong delta will move in tandem with the underlying. Courtesy: Sentrix, Westpac and Saxobank

Currency Strength Index: FxWirePro's hourly AUD spot index is inching towards 23 levels (which is mildly bullish), while hourly USD spot index was at 25 (mildly bullish) while articulating (at 10:52 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics