It seems rational that antipodeans currency crosses as “high yielding” avenues that suffer more as a result of the USD strength than most other G10 currencies.

After all the USD strength is based on rising US rate expectations that is obliterating the carry reasoning that so far supported the two currencies.

From that point of view, it seems illogical that the yen is also suffering disproportionately. It seems to me that the new BoJ strategy that was only received moderately positively before the election, is now perceived to be much stronger.

The fact that the BoJ is fixing long-term JGB yields seems a much more important measure if US yields are rocketing as a result of the new Fed view.

As a result of the underlying economic factors (as explained above), we think the Aussie and kiwi dollar would be in slight pressure against USD and JPY, with AUDJPY edging up higher at 81.475 levels, given a key channel resistance is broken at 81.777 levels, further upside can’t be ruled out as RBA’s easing bias for now has been on hold.

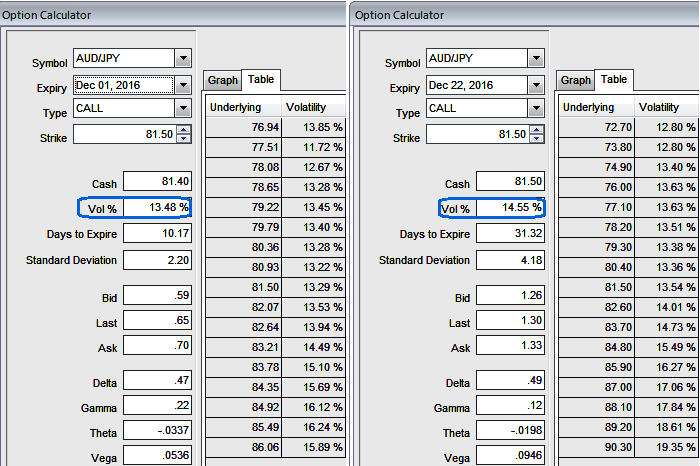

1w at the money volatilities of 50% delta calls and puts are at trading around 13.50 and 14.55% for 1m tenors which is reasonable as the vols currently are working in the interest of option holders as you can see IVs and corresponding movements in vega.

But for this week, we think the pairs such as AUDJPY are blowing out of the proportion in OTC FX markets that pops up with rising IVs above 13.5% for 1-week expiries despite having less significance economic drivers that propel this currency pair to anywhere.

But we think the same IVs with longer tenors are justifiable as there are series of considerable economic events lined up.

The data announcement of private Australian quarterly capital expenditure and retail sales are scheduled for next week. RBA’s monetary policy meeting, AU GDP QoQ, trade balance and Japanese current balance are scheduled for 1st week of December.

You can trade the IV value by monitoring an IV chart for a specific underlying market for a certain time period and determine the IV range. The peaks suggest the option is expensive to buy and the troughs suggest the option is inexpensive.

Well, in order to arrest this upside risk, we recommend option strap strategy that favors underlying spot’s upside bias.

So, we recommend building the FX portfolio exposed to this pair with longs positions in 2 lots of 1M ATM 0.51 delta calls and 1 lot of ATM -0.49 delta puts of the same expiries.

Since the upswings in near term seem to be dubious as per the signals generated by technicals as well as from risk reversals, this AUDJPY option straps strategy should take care of both upswings and any abrupt downswings just in case RBA surprises the forecasters, and the strategy is likely to derive handsome returns on the upside and certain yields regardless of swings on either side but with more potential on upside.

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation