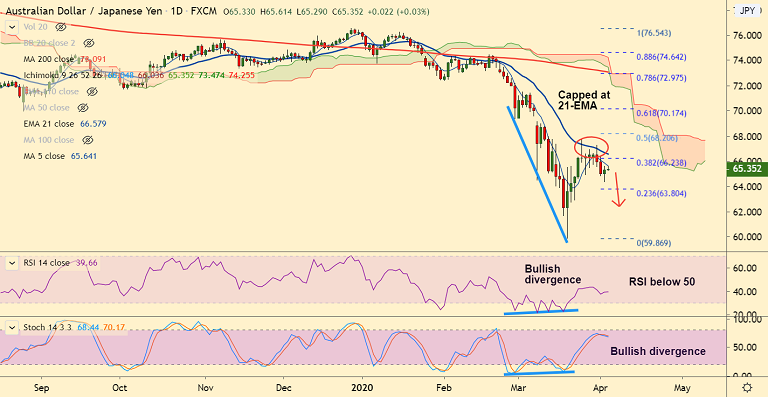

AUD/JPY chart - Trading View

AUD/JPY was trading largely unchanged at 65.35 at around 07:35 GMT, slipping lower from session highs at 65.61.

The pair was capped at 5-DMA resistance at 65.64, scope for downside resumption.

The Aussie dollar fails to benefit from above-forecast Aussie retail sales data and a rebound in the Chinese Caixin Services PMI.

Lingering concerns over the Japanese outbreak of COVID-19 would potentially jeopardise the yen's safe-haven allure.

Also, Moody’s on Friday, said it expects Japan’s GDP to contract by 2.4% in 2020, which will have knock-on effects on the job market.

Major trend in the pair is bearish. Price action has been rejected at 21-EMA and has edged below 200H MA.

Dip till lower Bollinger band at 62.811 likely. Breakout at 21-EMA negates bearish bias.

Support levels - 63.80 (23.6% Fib), 62.81 (Lower BB)

Resistance levels - 65.64 (5-DMA), 66.58 (21-EMA)

Guidance: Good to go short on upticks around 65.60, SL: 66.60, TP:65/ 64

Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One