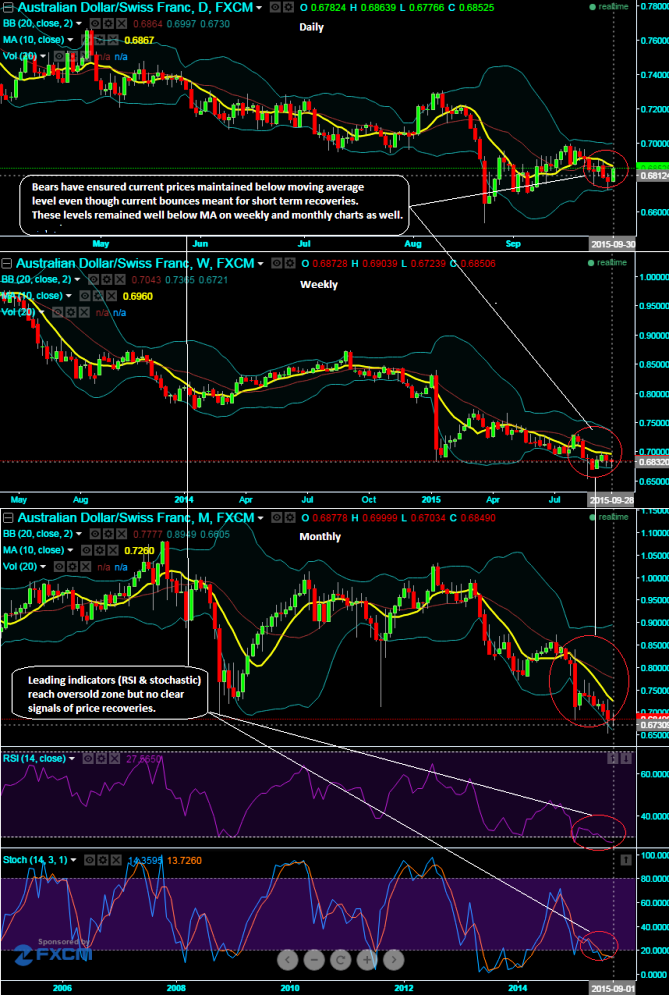

Although the pair managed to bounce back a little today, the current prices remained well within charts with all time frames (daily, weekly and monthly). For long term perspectives this would state us to maintain the bearish view in weeks to come. So for now we are capitalizing this ongoing downtrend by using recovery rallies with an objective of profit maximization.

It can be attained formulating AUDCHF options combinations if you think you are running short of capital exposure for spot FX shorting, derivative combinations (both call and put) are the right avenue for such class of traders so as to leverage extraction. We nearly replicated the short spot FX position by buying OTM puts and selling OTM calls. The net result is a virtually nil cost or even net credit trade that has uncapped risk potential as the EURGBP rises.

AUD/CHF spot FX is currently trading at 0.6850. Buy 1M 1.5% out of the money -0.49 delta puts and simultaneously sell 1.5% out of the money calls with comparatively shorter expiry (probably 7, 10 or 15 days time frame as suitable conditions).

With above technical reasoning, use this strategy as AUD/CHF long term bearish environment holding stronger despite intermediate attempts of bulls taking over rallies and wish to earn capital gains.

Advantage: With this strategy, you use no capital or negligible capital and yet are able to simulate a short spot FX position, and the ability to leg in and leg out as you wish.

Risk/Reward Profile: The risk is uncapped if the pair rises consistently towards north, while the reward equals lower strike plus net credit, or less net debit.

FxWirePro: AUD/CHF hedging framework as no trace of strength in long term

Wednesday, September 30, 2015 1:52 PM UTC

Editor's Picks

- Market Data

Most Popular