Economic events: Canadian GDP likely to have expanded and trade deficit to contract

Canadian economic data of recent hasn’t been very positive, MoM consensus are at 0.5% from the previous -0.6%, this would mean that the Canadian gross domestic product figures may indicate the economy contracted in Q2.

Given the previous economic backdrop, BoC maintained monetary policy unchanged at 0.5%. Central Bank to continue to pushing competitive weakness into their currency in order to keep trade flows afloat.

While Canadian Canada's merchandise trade deficit came in at CAD 3.63 billion in June 2016 compared to a revised CAD 3.50 billion gap in the previous month, missing market consensus.

As the Canadian currency has continued to be bolstered since beginning of 2016, this has ended exports into less competitive within the current backdrop of near-unanimous dovish Central Banks (FOMC the notable exception); and this has made to squash Canadian exports at a record clip in the early portion of this year.

Continued lag in exports may force the Bank of Canada’s hand before results of Trudeau’s stimulus might begin to show. But for the July month, the consensus stays to have contracted trade deficit flashes.

On the flip side, Australian building permits are scheduled to be announced today that is likely to be increased from previous -2.9% to 1.2%. While the capital expenditure in Australia is scheduled on Thursday, this economic number has been poor and would give an estimate of Australia’s actual investment in Q2 and an update on companies’ plans of investment for 2016-2017.

The focus would be on the prospect of non-mining business investment, where a small improvement is expected.

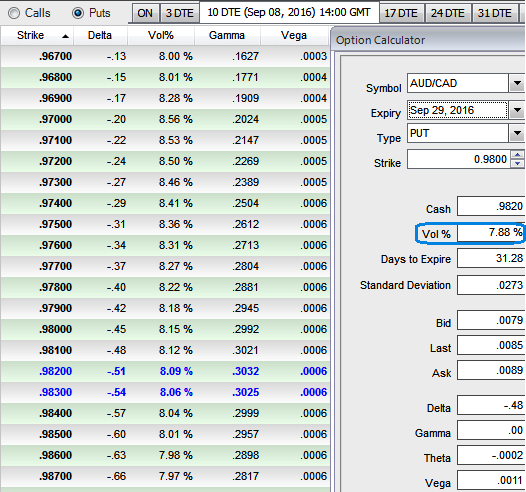

AUD/CAD represents stagnant Vega in OTM strikes despite mild IVs

In the short term, given the expectation of unchanged policy stance, AUDCAD spot FX is likely to remain in the range of 0.9955 on north or 0.9812 on the south but currently a little bias towards downward targets.

Despite the significant economic flashes as stated above, we see no notable activities in OTC FX of this pair. IVs of 1W ATM contracts are stagnantly creeping up from current 8.93% to 10.12% of 1w expiries.

This is because a small change in IV will make no difference on the likelihood of an option far out-of-the-money expiring ITM or on the likelihood of an option far into-the-money not expiring ITM.

ATM options are far more sensitive since higher IVs greatly increase their chances of expiring ITM.

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields