AUDCAD 6M vols appear decent buys given their depressed levels (not far from 2014 lows) and the uber flatness of the 3M-6M vol curve.

Realized vols are not stellar however in a dollar-centric environment; hence theta bleed on vol longs is best avoided via forward volatility (FVA) structures.

So, opening positions in OTM AUD puts/CAD calls to monetize a potential correction lower in the cross is the clean directional play; one can, for instance, consider buying 6M 0.91 AUD puts/CAD calls with leverage in excess of 5:1 as a medium-term bearish play, where the admittedly distant barrier (8% OTMS) is still within the realm of possibility, having been breached only last September after the CNY devaluation.

Alternatively, relative value constructs involving buying AUD puts/CAD calls vs. selling USD puts/CAD calls (live, no delta-hedge) appeal as low cost ways of assuming exposure to the same directional dynamic.

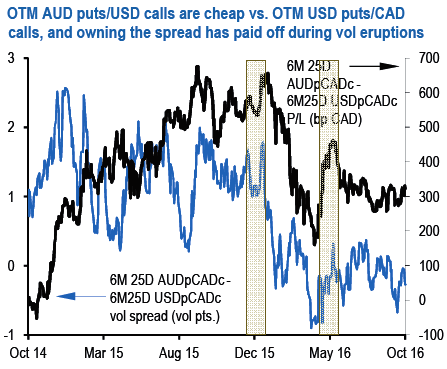

The above chart demonstrates that OTM AUD puts/CAD calls are historically cheap and discounted in vol (and premium for the same delta) relative to OTM USD puts/CAD calls, which is odd because their spread behaves like an anti-risk asset by virtue of effectively being short AUD/USD delta, and hence ought to command a net positive premium.

Cumulative P/Ls from owning 6M 25D AUD put / CAD call – 6M 25D USD put/CAD call option spreads (bp CAD), and 6M 25D AUD puts/USD calls.

All options live (not delta-hedged) and rolled into fresh strikes monthly. Shaded bars represent vol spike episodes. No transaction costs

The anti-risk nature of the AUDCAD – USDCAD option spread: it essentially mimics returns from an equivalent tenor/delta AUD put/USD call – but at a fraction of the cost of the latter and with outperformance in periods of calm when time decay is a drag on the latter.

The risk to the spread is evidently a major USD sell-off that hurts USD/CAD significantly more; the working assumptions are:

(a) This is unlikely to materialize in the lead up to the December FOMC; and (b) the risk of an upward drift in G3 rates poses upside risk for the greenback against lower quality EM FX that should keep a lid on large scale dollar washouts.

From a trade structuring standpoint, we also create some cushion against USD declines by striking options meaningfully out of the money (25D) such that local, small scale dollar weakness has low odds of filtering through to terminal option returns.

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures