As USDCNY breached a key support at 6.4772 levels recently, the market seems to be curious whether Chinese central bank would step up an effort to prevent its currency from appreciating too drastically.

China, with a mere 1.3% GDP surplus, has a FEER-consistent exchange rate that is 6.32 not that far from the current rate, really. Hence, PIIE agreement with Treasury Secretary Mnuchin’s conclusion that China is not manipulating its currency. In our opinion, CNY is not an outlier given the backdrop of broad USD weakness.

In this case, there is no emergency for the authorities to conduct a directional intervention. Over the foreseeable future, the PBoC would continue to anchor its currency to the currency basket.

It is highlighted that elevated carry/vol ratios near multi-year highs represented the single most noteworthy thematic dislocation in FX options. This is a result of rising interest rates intersecting with über-depressed financial market volatility and enables earning the leveraged carry in an upbeat global growth environment with low option premium spend and defined maximum loss.

The pro-risk sleeve of our options portfolio is accordingly composed of ATMF vs. ATMS call spreads in two EM currency pairs, EURCNH and EURRUB; the former because of its loose correlation to the CNY TWI that is expected to remain stable in coming months, and the latter as a play on oil price strength with additional macro support from a positive current account.

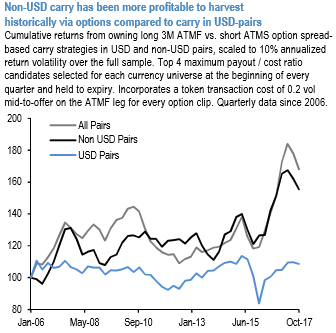

Both pairs have been chosen to dodge outright exposure to the broad dollar, which has been in line with the anticipation of moderate USD strength through 1Q’18 at the time of writing, and is also the historically more profitable approach to carry trading – 1st chart illustrates a selection of the best four carry/vol currency pairs bought in ATMF/ATMS option spread format and held-to-expiry fared considerably better for the non-USD currencies than in USD pairs over the past decade.

Stability in EURCNH and EURRUB spot last month fully justifies their selection as pure carry candidates, though in hindsight, swifter delta gains would have resulted from simply owning USD puts. At the current market, the best value within the option-based carry universe resides in TWD/INR, EURTRY, and EURCNH (refer 2nd chart). Courtesy: JPM

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different