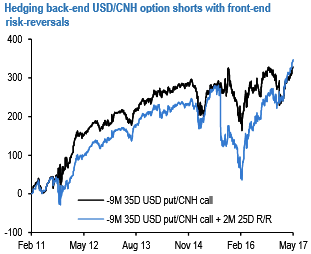

Hedging back-end USDCNH option shorts with front-end risk-reversals (equal USD notionals on all legs) does not detract from short vol returns while reducing drawdowns by 30%-40% Cum. P/Ls (bp USD) from i) selling 9M 35D USD puts/CNH calls, delta-hedged and ii) selling 9M 35D USD puts/CNH calls hedged with long 2M 25D risk reversals, equal notionals on all legs.

All options delta-hedged daily using smile forward deltas and option expiry matched forwards and rolled into fresh options monthly. No transaction costs.

Nonetheless, prudence demands that short FVA or FVA like option constructs require more protection than usual; we suggest buying 2M 25D risk-reversals against selling 9M 35D USD puts/CNH calls(both legs delta-hedged and in equal notionals/leg) that take into account the cheapness of risk-reversals across the curve, especially adjusted for the level of carrying in forwards.

Selling the weak-side of the risk reversal (USD puts) on the back leg is both RV efficient and ‘safer’ than selling ATMs or OTM USD calls (market will move away from short strike in a blow-up, rendering the vol short less painful than would be the case with ATMs and particularly OTM USD calls) while owning front-end riskies offers cheap protection against a gamma shock.

The above chart explains that our proposed quasi-hedged structure does not detract from core short vega returns, but helps mitigate drawdowns to the tune of 30%-40% in a 2015 China-devaluation like the event.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty