From last two days, gold price (XAUUSD) has been dipping from the peaks of $1,346.75 levels to the current $1,325.40 levels with overbought pressures.

Bullion Market’s OTC Indications: Please be noted that the positively skewed IVs of 3m XAUUSD contracts are indicating upside risks.

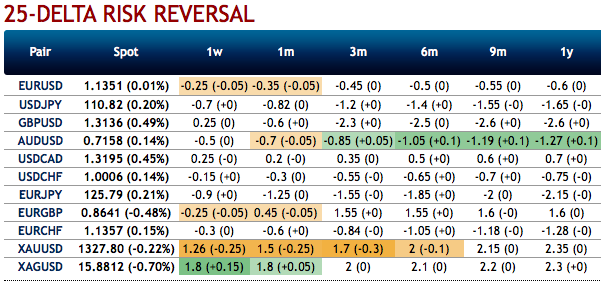

One could see fresh negative bids in the existing bullish risk reversal setup. To substantiate the above bullish sentiment, risk reversal numbers indicate an overall bullish environment.

The above risk reversal numbers have been known as a gauge of underlying market sentiment. Well, we know that options are predominantly meant for hedging a probable risk event in the future.

Option Strategy: Contemplating the minor dips in the short-run and OTC indications, capitalizing prevailing price dips of gold, we advocate longs in gold via ITM call options.

Buy 3m XAUUSD (1%) ITM -0.69 delta calls on hedging grounds. If expiry is not near, delta movement wouldn’t be 1 point increase with 1 pip in the underlying movement, which means if the spot moves 1 pip, depending on the strike price of the option, the option would also move less than 1. Thereby, in the money call option with a very strong delta will move in tandem with the underlying.

Alternatively, on hedging grounds, we advocated long positions in CME gold contracts for Feb’19 delivery, when the underlying was trading at $1,250/oz. We now like to uphold the same strategy by rolling over the contracts to March delivery as we could foresee more upside risks. Courtesy: Sentrix & Saxo

Currency Strength Index: FxWirePro's hourly EUR is at 71 (bullish), the hourly USD spot index is inching towards 3 levels (neutral) while articulating at 12:23 GMT.

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?