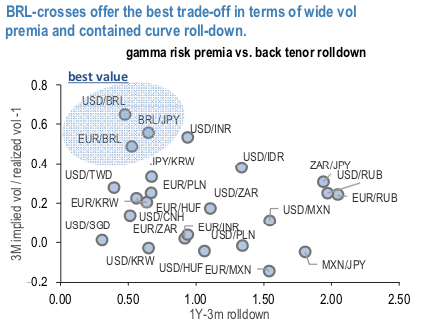

When focusing on pure vol plays, a natural implementation for the short EMFX vol theme is via delta-hedged calendar spread, where the short-vol leg benefits from the vol carry and the long leg serves as a hedge. At current market, BRL-crosses stand as the best calendars with their wide vol premia and contained curve roll-down (refer 1st chart). SVM based gamma trading model sees BRL vols as strong tactical sell (TWD being the only other pair among the G10 and EM pairs that we track in the SVM model). Moreover, across a set of liquid EM-pairs BRL screens as one of the best systematic performers (refer 2nd chart).

The implementations for the milking BRL vol carry (Vol calendar expression): To asses a risk from sell-offs to the short gamma leg we analyze past episodes of SSR vote optimism and disappointments particularly focusing on the drawdowns that occurred during the sharp selloffs (refer 3rd chart). The so-called “Temer tapes” in May 2017 and the April/May 2019 vote delay disappointment show 3vol and 2vol losses, respectively. The losses got pared within 1 quarter. A back of the envelope calculation indicates that a sharp, one-day 2.5% move could correspond to about 1.5 vol loss even if no change in the BRL vols. The current 3M implied realized vol gap (>4vols wide) should well sustain a 1.5vol hit on the bottom line assuming that the large spot gyrations do not persist.

Keeping in mind the risks, we recommend: Delta-hedged short 3M 25 strangle@ 11.95/12.3ch vs. long 12M straddle in USDBRL @12.9ch indic vols, in vega neutral notionals. Courtesy: JPM

Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes