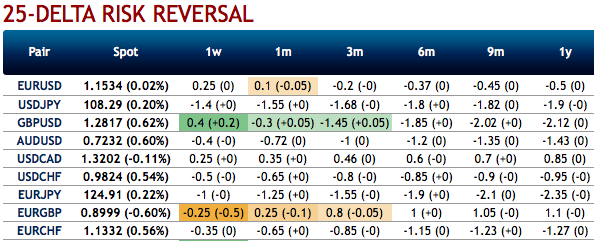

The positive bids in the shorter tenors have been observed to the bearish risk reversal atmosphere in the GBP OTC markets, this is interpreted as the hedgers are keen on bullish risks in the short-run, whereas the long-term bearish outlook remains intact.

You could easily make out that the positively skewed IVs of EURGBP have been stretched out on either side. This is interpreted as the hedgers bid for both OTM calls and OTM put options.

Tomorrow the House of Commons is likely to reject the Brexit deal negotiated between the government and the EU. The fact that Prime Minister Theresa May postponed the vote from then to tomorrow is merely another twist in the constant chaos the political system in Great Britain is currently providing for the surprised spectators. Neither sentiment nor the subject of the vote has changed significantly since then something that all reasonable observers were perfectly aware of at the time.

May herself will warn today that much has already emerged in front of fervent Brexit supporters, that rejecting the deal would increase the likelihood of Brexit being called off. The fact that she is referring to a scenario of this nature as a disaster for democracy. This is not a place to pass judgment on who and what is currently damaging democracy in a more significant manner. And it would be far too depressing to read first thing in the morning anyway.

However, this is a place to state the fact that May’s interpretation suggests that the political process is going to result in a “remain” decision (i.e. that Brexit is going to be cancelled) and that remain is the most GBP positive of all imaginable scenarios. But of course things are not that simple. Of course to accept the deal would mean that “remain” is out of the question. However, rejecting the deal also means that a disorderly Brexit and as a result probably significant GBP depreciation remains possible.

Even within her own Cabinet hardly anyone listens to the Prime Minister; and as a result, we consider it to be unlikely that the FX market will follow her GBP positive interpretation of tomorrow’s rejection of the deal. However, the vote if it ends as expected (reasonably clear rejection of the deal) is likely to be neutral for Sterling, not only because that outcome has been expected. It is also due to the fact that it continues to keep open GBP-positive, GBP- negative and GBP-neutral scenarios.

To allocate a probability to these scenarios is currently a popular pastime amongst UK analysts. For the majority of participants of the FX market this is of minor significance. Hardly anyone is likely to be sitting on a portfolio (or underlying business) that is completely immune to Brexit risks if only for the simple reason that the different outcomes can cause risk-on and risk-off moves.

As a result what is most important in determining the premiums of Brexit risks is how much “pain” the different scenarios will cause to the FX market participants on average. Anyone who thinks like that will have to maintain their hedge against extreme scenarios. Only anyone who is totally unaffected can bet on GBP-positive or GBP-negative scenarios, if he believes that the probabilities which are priced would “incorrect”.

However, the question arises as to whether there may not be bets available on the market for these market participants with chances of winning that are easier to judge. And as that is the case hardly anything changes on the GBP options market – with the exception of the opinion on when GBP decisive decisions are due. Courtesy: Commerzbank, Sentrix and Bloomberg

Currency Strength Index: FxWirePro's hourly GBP spot index was at 115 (bullish) while articulating (at 11:03 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays