We witness the impulsive nature of the rally from 1.2505 is the start of a broader correction within the medium-term range, towards the 1.27 region. As such, we are monitoring pullbacks, which should, if we are right, develop a higher low in the 1.2670-1.2610 region. A decline through there would force us to a more neutral stance as it would suggest a greater risk of prices just moving into a lower range and the increased risk of a test below 1.2440.

Furthermore, we emphasize on what makes the difference between a trader and a successful trader in this write-up. But before proceeding further, let’s just quickly glance through GBP OTC outlook.

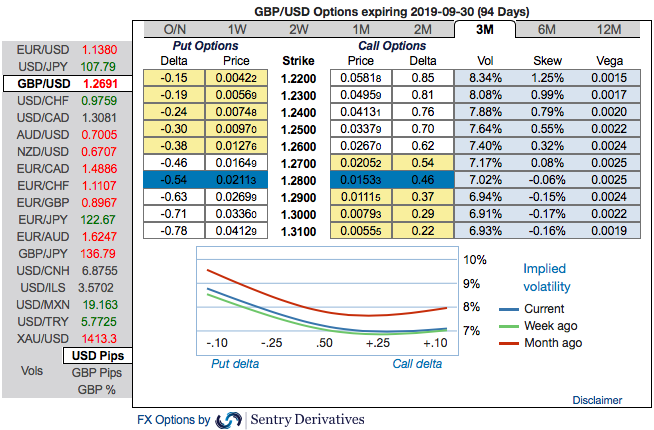

OTC outlook: Bearish The positively skewed implied volatilities of 3m tenors have still stretched towards OTM put strikes, whereas 1m skews have been well-balanced on either side. While bearish neutral risk reversal numbers have been observed in the GBPUSD risk reversals across all tenors. To substantiate the downside risk sentiment, risk reversals have also been signaling bearish hedging sentiments.

From the GBP OTC outlook, amid major downtrend we reckon that the sterling should not suffer like before, but, one should not disregard the Brexit settlement risks on the other hand. The market has always ignored the fact that all the current BoE interest rate moves are due to a favorable result of the Brexit process.

Both the speculators and hedgers of GBPUSD are advised to capitalize on the abrupt price rallies for bearish risks in the long run and bidding theta shorts in short run (1m IVs) and 3m risks reversals to optimally utilize delta longs.

Strategic Options Recommendations: Contemplating the above factors, we load up more delta long instruments comprising of ATM puts, simultaneously, OTM shorts in short-term would optimize the strategy.

So, the execution of strategy goes this way: Short 1m (1%) OTM put option (position seems good even if the underlying spot goes either sideways or spikes mildly), simultaneously, initiate longs in 2 lots of 3m ATM -0.49 delta put options.

The position is a spread with limited loss potential, but varying profit potential. The degree of profit relies on the strength and rapidity of price movement. The position uses long and short puts in a ratio, such as 2:1 or 3:2, to maximize returns as explained above.

Many times, despite the traders’ calls go right, they end up losing money. Well, it doesn’t need to make them as successful traders. There is much difference between a trader and a successful trader, because, every trader has strengths and weakness, be it any asset class or be it any trading instrument. As per some legendary trading quote, “some are good holders of winners but may hold their losers a little too long. Others may cut their winners a little short, but are quick to take their losses.”

An ordinary trader is the one who could be right 8 out of 10 times, whereas a successful trader is the one who makes more money than an ordinary trader even when whose calls are right only 2 out of 10 times (that’s the reason why we loaded up the long leg with ATM puts).

It all depends on how much return that your strategy has fetched you when your trade convictions are right. Well, in that perspective, before proceeding further let’s just quickly glance at OTC outlook and suitable strategy for GBPUSD swings.

In most long/short spreads, you make money if the spot fx moves, but you lose if it remains in the middle “loss zone.” A ratio put back spread is different because it reduces the cost of trading as it generates credit also from short leg, so even if the underlying spot FX price does not move very much, you keep the credit if all of the puts expire worthless.

Every underlying move towards the ITM territory increases the Vega, Gamma, and Delta which boosts premium. Courtesy: Sentrix & Saxo

Currency Strength Index: FxWirePro's hourly GBP spot index is inching towards -45 levels (which is bearish), while hourly USD spot index was at 45 (bullish) while articulating (at 12:42 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential