We think the precious environment for platinum will remain supportive in 1H’20, with platinum prices peaking at an average price of $950/oz before further signs of a business cycle extension weigh on prices in 2H’20.

We have consistently flagged over the last year that as a consequence of our place in the business cycle, our PGM price forecasts have been based more on the macro environment than on strict S&D fundamentals.

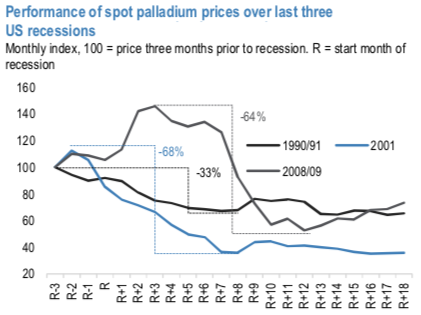

As we highlighted below the bearish and bullish scenarios, outside of a slight boost to the automotive demand estimates, overall view on platinum and palladium S&D fundamentals hasn’t substantially changed. However, based on a view calling for increasing macro headwinds in 2020, JP Morgan was projecting a stark turnaround in palladium prices similar to what we had seen over previous recessions.

Conversely, we also saw an opportunity for platinum to ride gold’s bullish coattails despite its chronic physical surpluses. Now our macro view for 2020 has been tempered significantly, which has triggered a rethink on PGM prices next year. Essentially, we now think the risk of imminent recession will likely ebb in 2020 as global central bank easing throughout 2019, combined with fading tail risks on trade, will be enough to stabilize global manufacturing and extend the current business cycle for the time being. As such, we have emphasized palladium projections meaningfully higher while trimming some of the upside we previously saw in platinum, but we’ve listed out quite a few bearish and bullish scenarios of platinum.

Bearish Platinum Scenarios:

1) The correlation between gold and platinum breaks down as platinum's lacklustre fundamentals are too large of a hurdle for precious-minded investors;

2) The implied technical support at $800/oz fails to hold, opening downside for prices;

3) Economic growth globally comes in much stronger-than- expected, prompting a quicker-than-expected reversal in the recent dovish shifts from major central banks.

Bullish Platinum Scenarios:

1) More constructive macro outlook for 2020 proves to be too optimistic as recession risks continue to rise and trade tensions remain elevated;

2) Clean diesel is reinvigorated by new technology stemming diesel share losses;

3) Chinese HDD vehicle platinum loadings increase more-than-expected, offsetting losses elsewhere;

4) Platinum demand gains materially from substitution away from relatively higher-cost palladium in the automotive sector.

For palladium, this softening in the 2020 outlook has prompted us to cut out the severe downside we previously forecasted, which was based on palladium’s average 55% drop peak to trough over the past three US recessions (refer above chart). This reduction in macro bearishness drives the bulk of our upward revision, however we still retain a bearish price trajectory on the metal next year, with prices moving from a forecasted $1,675/oz 1Q'20 average to a $1,450/oz 4Q’20 average. Courtesy: JPM

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data