While everyone should have somehow gotten used to Trump's style, the market still seems to be disappointed after Trump said "I have no deadline (for the trade deal". However, this is justified in my opinion. First, given the more complex US-China political dynamics after the Hong Kong and human rights bills, it is hard to expect a smooth trade negotiation process. Second, both sides are reluctant to back down on the sticking topics.

For the US, it is hard to roll back the existing tariffs - which might not been seen as a victory even a phase 1 deal could be reached.

For China, for now it looks impossible to put a specific amount of farm good purchases in the trade documents, which would be regarded as a humiliation. That said, Trump's "no deadline" rhetoric just tells us that little progress can be made for the time being. For the market, the fears are mounting as the Dec 15 tariff deadline is approaching. While it is a 50-50 call whether the tariffs could be delayed, it seems nonsense for Trump to spoil the Americans' Christmas party. Obviously, Mr Trump is unpredictable, which poses a risk to the market in the coming days.

While the precious metals underwent a major regime change in May, when gold sprang to life amid the May US/China trade outburst. 3M gold vols jumped 5vols and silver 10vols as spot moved up 15% and 25%, respectively. The vol reaction was in line with our prior analysis. Owning gold vol used to be an underwhelming proposition during the US/China trade episodes in 2018 due to quick reversals and vol seller’s downside pressure. The May - Sep gamma outperformance pushed the YTD P/L into positive territory even as the broad-based Sep/Oct FX/Precious vol sell-off jeopardized those gains.

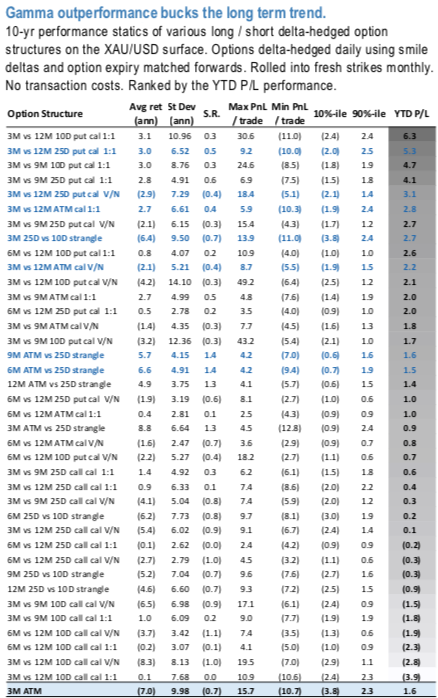

The above nutshell displays long-term and YTD performance of various calendar and vol spread structures. Long term performance favors irrespective of tenor vega neutral long straddles vs short strangles at impressive 1.3-1.4 Sharpe. Vega neutral short front vs long back tenor OTM call vol calendars perform only marginally worse. YTD 9M straddle vs 25D strangle vol spread and short 3M vs long 12M 10D call vol calendar posted 1.6vols and 2.8vols returns, respectively. While appealing, those returns are quite modest relative to their long term performance.

While Gold and Palladium are already far into an internal 3rd wave rally of greater scale, we see great catch-up potential for Silver and Platinum, which are still in the very early stages of it. In line we see the Gold/Silver spread trading significantly lower.

What is more eye-catching is the 2019 gamma outperformance, in our view. Bucking the long-term strongly negative trend, 3M delta-hedged straddles are up 1.6vols YTD. Theta friendly long gamma / short vega calendars were particularly efficient in exploiting the gamma performance.

We advocate buying delta-hedged 1Y XAUUSD 1*2 ATM/25D strikes ratio call spread @12.2ch vs 15.25/16.25indic, vega notionals. Courtesy: JPM & Commerzbank

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure