South Africa’s fundamental picture remains very challenging with a ballooning fiscal deficit and structurally low growth. We have outlined our structural case for weaker ZAR here, with the currency likely to have to play the role of the adjustment valve vs. the fiscal and growth challenges. Fiscal challenges are now becoming ever more apparent with the appropriation bill seeking extra R59bn of funding for SOEs over two years.

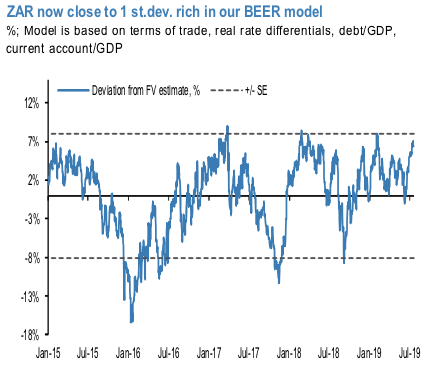

This is consistent with our economist’s assumptions underpinning her 5.7% of GDP fiscal deficit forecast for this year and 5.3% of GDP for next year. Meanwhile, our economist expects GDP growth to be capped at 0.5% this year recovering only marginally to 0.8% next year. This macro backdrop, in our view, is inconsistent with the recent ZAR rally even when accounting for a supportive global environment. ZAR valuation is now stretched (refer 1st chart).

In the past, our BEER model has acted as a very good signal to short ZAR whenever the overvaluation reached stretched levels close to the standard deviation of the model. We have now approached this trigger. Terms of trade have recently boosted ZAR, but our model suggests ZAR appreciation has exceeded this support. Interestingly, we estimate the gold rally explains about 1/3 of the rise in South Africa’s terms of trade since May 20.

However, speculative gold positioning now looks rather extended, which may put breaks on a further rise in the terms of trade.

Overall, J.P. Morgan’s commodity projections are consistent with a 0.7% fall in terms of trade by end Q3’2019 (refer to 2nd chart).

Contemplating the above factors, we recently recommended going short ZAR via a 3-month 14.75 USDZAR call. We have maintained a UW position in our GBI-EM portfolio since May 13, arguing that the sharp deterioration in the fiscal and growth outlook is likely to lead to ZAR underperformance. However, a supportive global environment has lifted ZAR despite fundamentals. We now believe levels are stretched enough to enter outright ZAR shorts. Low implied volatility makes option trades particularly attractive. The call is indicatively offered for 1.2150% (activated when the spot was 13.89 levels). Courtesy: JPM

US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand