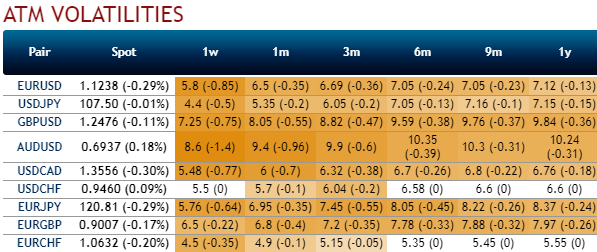

The above nutshells showing IVs and risk reversals of G10 pair, where implied volatilities are turning lower and you could also make out that there has been bearish hedging sentiments for dollar except USDCHF.

The FX option markets appear oblivious to this unusually high degree of unpredictability. On JP Morgan’s workhorse cyclical model of FX vol, current levels of VXY screen 4 pts+ too low (3-sigma misalignment – refer 1st chart). We caution against taking this massive undershoot at face value however, since much of it is driven by recessionary levels of PMI and abnormally elevated forecast uncertainty around key economic variables such growth, inflation and unemployment as flagged earlier, both of which should normalize in coming months as economies reopen from lockdowns and visibility on Covid damage improves. Also, the disconnect between manifestly poor macro conditions and unfazed asset markets is hardly a FX vol-specific phenomenon; if core asset markets in the eye of the storm such as equities and credit can remain persistently misaligned vis-à-vis growth / default risk fundamentals thanks to Fed intervention, currency vol can hardly be expected to be the ground zero for a major macro vs. market realignment. At a minimum though, the vol vs. macro setup suggests that a high degree of caution is warranted around short volatility trades, since the outsized fear premium of 1Q’20 has long become history. Not to mention that sub-par liquidity in these challenging market conditions raises the bar for short risk premium trade constructs.

The most obvious counter to this cautious view of risk is that Fed fund rates have fallen to zero, as have other DM policy rate targets. There is a legitimate case to be made that with policy interest rate differentials collapsing in the wake of synchronized rate cuts across G10, current carry-to-vol ratios are already too high, and therefore FX vols do have room to fall once the dust settles on Covid.

Nowhere is this disconnect starker than in the case of USDJPY risk-reversals – the one currency pair that has historically co-moved the strongest with rate differentials, and where historically stretched skew / ATM vol ratios are at severe odds with near-zero interest rate carry on forward delta hedges. Indeed a formal econometric model linking FX vol to interest rate vols and correlations between them finds the former to be meaningfully overvalued (refer 2nd chart), though this observation is undercut somewhat by the counter that on different cross-market variables such as equities, VXY has substantial catch up room higher. Net-net, this push and pull of offsetting factors leaves the directional FX vol view for H2 somewhat murky, and is a microcosm of the indecision hobbling investors from enthusiastically embracing the reflation rally in other asset classes. The current environment strikes us as a poor one for making a cavalier macro-directional call on volatility. We will look to keep risk fairly tightly controlled in our trade recommendations, prioritize relative value over outright vol longs or shorts, and attempt as best as possible to embed a degree of long vol protection even in RV constructs. The rest of this note outlines some key FX option themes around which we will try to organize our recommendations in coming months. Courtesy: JPM

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025