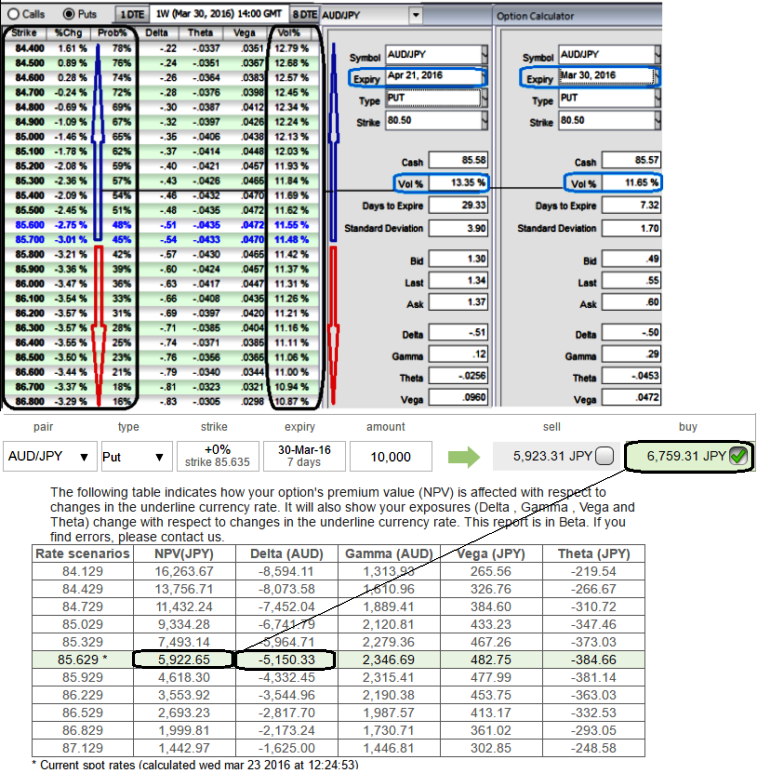

As shown in the diagram, please be noted that the Vega of OTM strikes are at the highest positive levels along with higher vols.

The premiums of ATM strikes are trading at around 14.13% more than NPV.

We know that the Vega is the sensitivity of an option’s value to a change in volatility (ATM vega is at JPY 482). It is usually expressed as the change in premium value per 1% change in implied volatility.

That means if the long option position has positive Vega and IVs spike or dip by every 1%, the option’s premium would also correspondingly increase or decrease by JPY 482.

Most importantly, 1W implied volatility is at the 11.65%, , these vols are spiking from 11.65% in 1w expiries to 13.35% in 1m expiries.

Options with a higher IV cost more. This is intuitive due to the higher likelihood of the market 'swinging' in your favour. If IV increases and you are holding an option, this is good. You should also note short-dated options are less sensitive to IV, while long-dated are more sensitive.

If you have to evaluate these vols and premiums with probabilistic figures in distinctive scenarios of OTM strikes, the options pricing seems reasonable, which means more likelihood of these puts expiring in the money.

Hence, we reckon the vega instruments are more conducive in bearish hedging.