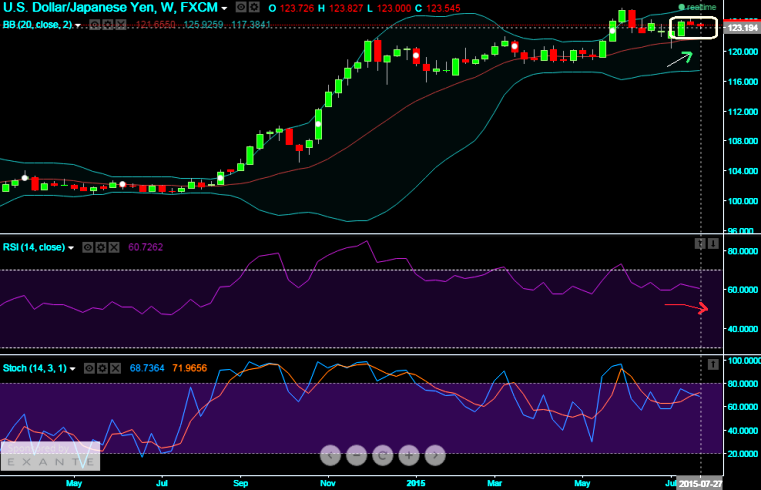

We see the trend going in tight range between 124.467 - 122.158 from last fortnight or so which we perceive this as non directional but slightly downward bias since some bearish signals for short term basis are popping up. This has always been extremely tough & risky to have opened position in non-directional trend.

USD/JPY's non directional pattern is persisting but some bearish candles are indicating slight bearishness, candles such as resembling Doji occurred at 123.759 and RSI signals divergence with rising prices which means trend reversal to happen in near future, while on stochastic curve %D line crossover is attempting near 68 levels.

Option trade recommendation: Naked Straddle Shorting

As we foresee non-directional trend is puzzling this pair on EOD charts we like to remain in safe zone and recommend shorting a straddle using At-The-Money options, thereby, one can benefit from certain returns by shorting both calls and puts.

Short ATM put and ATM call (strikes at 123.543) simultaneously of the same expiry (preferably short term for maturity is desired).

Maximum returns for the short straddle is achieved when the USD/JPY price on expiry is trading at around 123 levels only as both the instruments have to wipe off worthless. So that the options writer gets to keep the entire initial credit taken as profit.

FxWirePro: $ adamant to give up bullish momentum against ¥; naked straddle shorting for speculators

Wednesday, July 29, 2015 6:31 AM UTC

Editor's Picks

- Market Data

Most Popular

9

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings