European Central Bank's (ECB) unprecedented easing, which has unleashed more than €250 billion of liquidity in Euro zone seems to be working its magic for the economy as well as almost all subsectors, as per latest data from Markit economics.

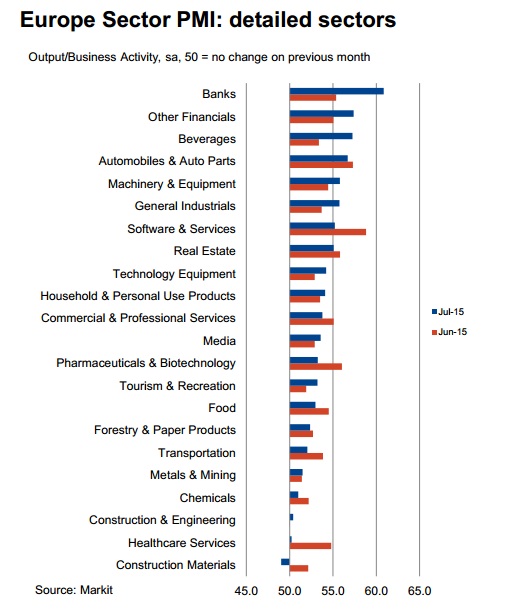

According to sectorial PMI research,

- In July, Banks topped sectorial rankings, suggesting ECB's easing finally sipping into the performance of the sector, which is expecting better business days ahead. Financials were the fastest growing broad sector.

- Data also pointed out that consumers are warming up to better economic days as strong expansion in output were registered in beverages to Automobiles to Tourism.

- Commercial sectors seem to be improving to with expansion seen across industry, with greater expansion for machinery and equipment.

- Construction, however continues to lag and even contracted in July from June.

In spite of rate hike from FED and all global headwinds, European stocks are likely to outperform going ahead, especially after the rate hike from US Federal Reserve.

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns