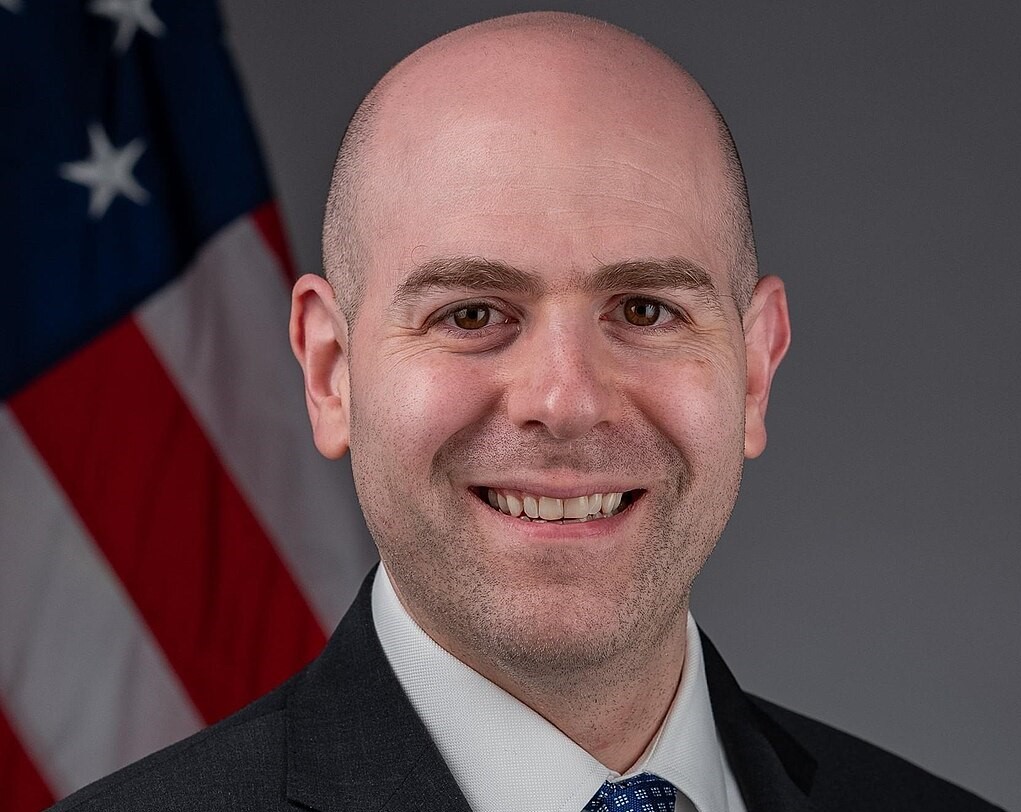

Federal Reserve Governor Stephen Miran expressed confidence that the central bank’s plans to ease monetary policy will not dangerously inflate already elevated asset prices. Speaking to Reuters on the sidelines of the Institute of International Finance meeting on Thursday, Miran said asset prices are influenced by a variety of factors beyond monetary decisions.

“There’s a lot of things that drive asset prices,” Miran stated. “Monetary policy is one of them, but fiscal policy, regulatory changes, and global developments also play major roles.” He emphasized that while some analysts worry that lowering interest rates could fuel another asset boom, the Fed’s primary focus remains on achieving its dual mandate — price stability and maximum employment.

Miran noted that when evaluating financial conditions that most impact the real economy, housing markets stand out as a critical factor. “When I think about the financial conditions that matter most for the real economy, it’s those related to housing — and those look a lot less easy,” he added.

His comments come as the Federal Reserve faces pressure to balance easing measures with concerns about overheated markets and persistent inflation. Despite record-high valuations in equities and real estate, Miran believes broader economic fundamentals — rather than monetary easing alone — drive current price trends.

Market observers continue to debate whether the Fed’s future policy shifts could reignite speculative behavior in risk assets. However, Miran’s stance suggests that the central bank remains confident in its approach, prioritizing inflation control and labor market strength over fears of an asset bubble.

By reaffirming the Fed’s commitment to economic stability, Miran’s remarks offer insight into the nuanced view policymakers hold on asset valuations amid evolving monetary strategies.

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  U.S. Stock Futures Edge Higher as Tech Rout Deepens on AI Concerns and Earnings

U.S. Stock Futures Edge Higher as Tech Rout Deepens on AI Concerns and Earnings  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Oil Prices Slip as U.S.–Iran Talks Ease Supply Disruption Fears

Oil Prices Slip as U.S.–Iran Talks Ease Supply Disruption Fears  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target