Federal Open Market Committee isn't expected to change US interest rates at the end of its two-day meeting but may give an indication of the timing for a hike. Though members of the committee have foreshadowed three more 25 basis points rate hikes this year, there is no expectation that the Fed will follow up December’s 25 basis point increase in US short-term rates with another rate rise at this week's policy meeting. The FOMC will release a statement Wednesday with no press conference to follow.

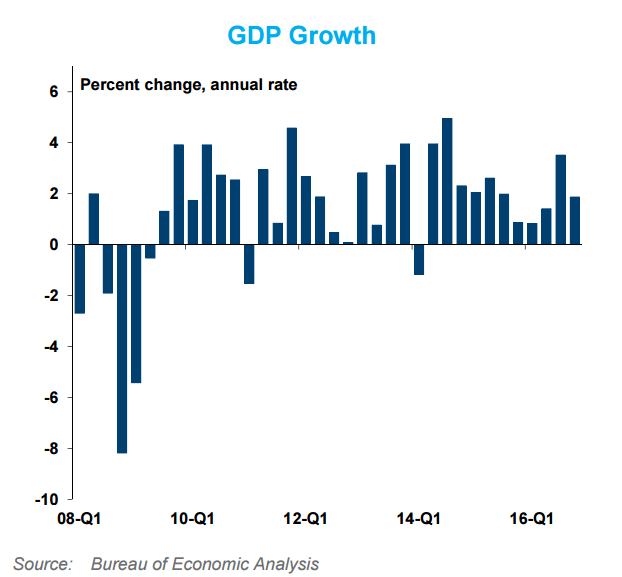

The US economy grew moderately in the fourth quarter, with a growth of 1.9 percent. Marked changes in net exports and inventory investment were seen. While net exports constrained economic growth in the final months of 2016, inventory investment added a full percentage point to the advance in GDP. A steady pattern that seems to be developing suggests that the trade sector offers encouragement for the outlook in the year ahead.

The business fixed investment component of GDP has been notably soft in the past two years, but a hint of improvement did indeed emerge in Q4, as total fixed investment grew 2.4 percent overall. Prospects in the quarters ahead seem promising and the business-friendly environment that could emerge in the Trump administration might boost optimism and spark spending. That said, the Fed is likely to err on the side of caution, waiting to see how the campaign promises translate into actual policy.

Comments from regional Fed presidents have sparked prospect of an eventual start of the unwinding of Fed's balance sheet which has expanded to about $US4.5 trillion. Yellen has said that halting the reinvestment program would be equivalent to two 25 basis point rate rises. She has said that the impact of the Fed’s balance sheet on longer-term rates was diminishing, which she described as “passive tightening” of monetary policy. A decision to begin shrinking the Fed’s balance sheet would, therefore, be a policy of more active tightening.

December Fed meeting sparked a bond sell-off, the third-largest rise in yields since the committee started holding press conferences and publishing rate projections after every other meeting in 2012. While there is no expectation of an immediate shift in the Fed’s balance sheet strategies even the hint that a reduction in its size has the potential to roil markets.

"We look for the Fed to be on the sidelines for the next several months. We doubt that officials will push interest rates higher until they have a reasonably clear view on the fiscal changes that will occur under the new administration and Congress." said Daiwa Capital Markets in a report.

USD/JPY range-bound on the day, trading at 114.70, while EUR/USD was 0.07 percent lower on the day at 1.0682 at around 1130 GMT. FxWirePro's Hourly Dollar Strength Index was neutral at 9.18583 (a reading above +75 indicates a bullish trend, while that below -75 a bearish trend). For more details, visit http://www.fxwirepro.com/currencyindex.

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty