Although the tone of the June FOMC meeting was more dovish than markets likely expected given the improvement in recent data releases, there was no real news. Chair Janet Yellen continued to sound cautious, still seeing sizeable labour-market slack, believing recent wage gains were only "tentative", and emphasising the need to see stronger GDP growth before the first Fed policy rate hike.

Chair Yellen was non-committal on the timing of the first hike, offering little guidance except highlighting new 'dots' (projections), which showed that most participants expect a rate hike this year - Yellen thinks this is "appropriate".

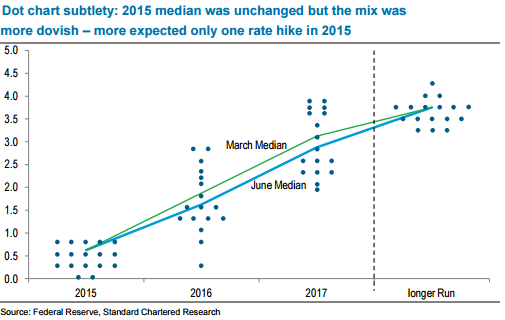

Even though the new dot chart showed an unchanged median forecast of 0.625% for the fed funds target rate at end-2015, several dots were revised down from March's projections. A characteristic of the dot chart is that the non-voters tend to be more hawkish than voters.

Yellen reiterated the need to de-emphasise the first rate hike (selling the 'dovish tightening' scenario), saying that what matters is the slow pace of tightening thereafter. This focus was echoed in falling median dots across the curve, by 25bps for 2016 and Fed remains data-dependent and market conditions matter.

Standard Chartered notes:

- We have long viewed the July meeting as an unlikely time for the first rate hike.

- We still think the Fed could pull the trigger in September if growth picks up over the summer, which seems likely.

- We expect very gradual tightening of one hike each quarter until a relatively shallow rate plateau of 2.0% in Q1-2017

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022