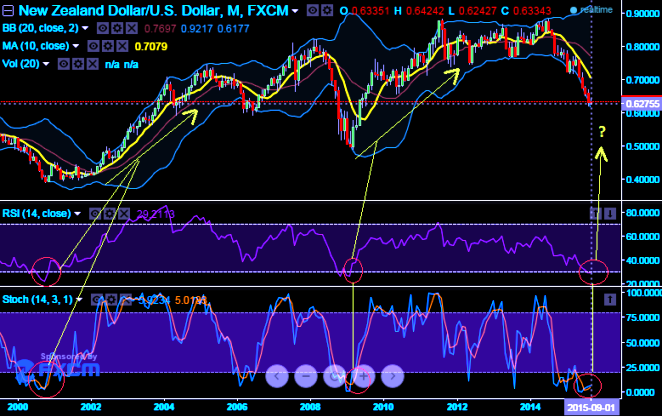

Technical glimpse: On weekly charts, from last April the pair has been tumbling non-stop from the peaks at 0.7736 levels to evidence the huge loses. The pair currently held strong supports at 0.6200 levels from one and half months. You can observe on the monthly charts for the historical evidence as to how the pair has behaved whenever RSI and stochastic curves have simultaneously reached oversold zone. Kiwi dollar after continues losing streak that has begun from mid April, it is now making an attempt of recovery a bit as both RSI and stochastic oscillators signaling buying sentiments in oversold zone.

No doubt, long term trend has been bearish, because of the above bearish signals ahead of fed's rate decision within shortly, would this pair hold onto 6 year's low and bounce back again..? The dubious eye on USD has been worrisome. Thus, in order to participate in continuous downtrend, at the money call can be deployed.

This ATM protective call can serve as a hedging strategy whereby the trader, who has an existing short position in NZDUSD, buys call options to guard against a rise in the price of that security. At this point in time (six and half year's low and Fed's crucial rate decision), a protective call strategy is employed if you are still bearish on NZDUSD but wary of uncertainties in the near term. The call option is thus purchased to protect unrealized gains on the existing short position in the underlying.

The protective call also be replicated as synthetic long put position as its risk/reward profile is the same that of a long put's. Like the long put strategy, there is no limit to the maximum profit attainable using this strategy.

FXWirePro: NZD/USD protective call replicates synthetic put - hedges spot FX shorts

Thursday, September 17, 2015 11:26 AM UTC

Editor's Picks

- Market Data

Most Popular