Bearish scenarios of AUDUSD are foreseen below 0.74 given:

1) the unemployment rate moves back towards 5.75%, raising risks that the RBA responds to a weakening labor market;

2) the Fed responds to firm labour market outcomes and above-trend growth by delivering a faster pace of hikes than currently expected;

3) China data weaken materially; or

4) risk markets retrace and vol rises.

Potential trigger events: CoreLogic House Prices (Jun): 2 July, RBA (Jul): 3 July.

We forecast AUD to decline to USD0.72 by 2Q18. Both monetary policy divergence and minimal support from commodity prices are expected to push the currency lower over time.

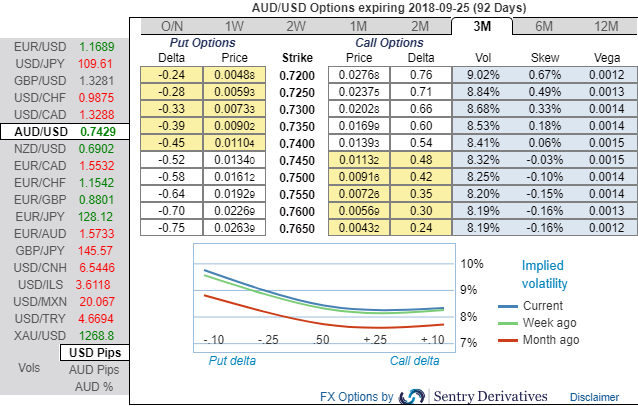

OTC outlook:

Please be noted that the positively skewed IVs of 3m tenors signify the hedgers’ interests to bid OTM put strikes upto 0.76 levels (above nutshell). While bearish neutral delta risk reversal indicates that the hedging activities for the downside risks remain intact.

Accordingly, put ratio back spreads a couple of days ago were advocated, wherein short leg is functioning as the underlying spot FX keeps spiking, we would like to uphold the same strategy on hedging grounds.

Both the speculators and hedgers for bearish risks are advised to capitalize on the prevailing price rallies and bidding theta shorts in short run and 3m risks reversals to optimally utilize Vega longs.

On hedging grounds, fresh Vega longs for long-term hedging, more number of longs comprising of ATM instruments and ITM shorts in short-term would optimize the strategy.

So, the execution of hedging positions goes this way:

Short 2w (1%) OTM put option (position seems good even if the underlying spot goes either sideways or spike mildly), simultaneously, go long in 2 lots of vega long in 1m ATM -0.49 delta put options. A move towards the ATM territory increases the Vega, Gamma, and Delta which boosts premium.

Thereby, the above positions address both upswings that are prevailing in short run and bearish risks in long run by vega longs.

Currency Strength Index: FxWirePro's hourly AUD spot index is inching towards 45 levels (which is bullish), while hourly USD spot index was at -156 (bearish) while articulating (at 12:15 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis