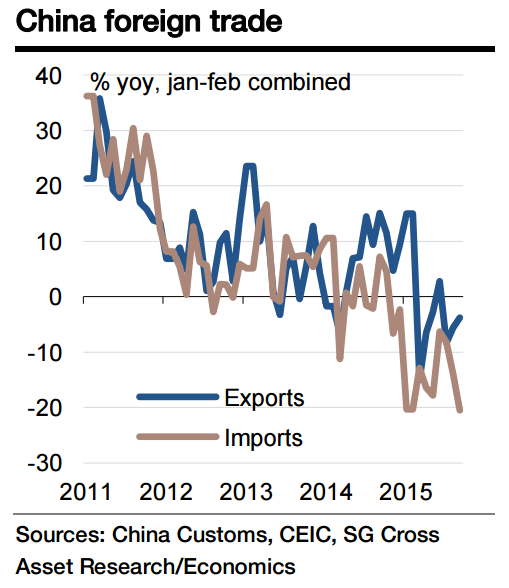

China's export growth is expected to return to positive territory in October. A slightly positive base effect should have helped, and there have been a few small positive signs, such as the good sales performance of new iPhones and the improvement in Taiwan export orders.

Import growth likely improved too, from -20.4% yoy to -15% yoy. Domestic demand might start to stabilise and commodity price deflation did not deepen further. However, for a more notable improvement in import data, we may still have to wait for a few more months. As a result, the trade surplus is expected to swell further to a new record of $71.7bn.

Export recovery expected in China

Wednesday, November 4, 2015 9:54 PM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX