The eurozone economy failed to gain momentum in June. Markit's PMI reading for June released earlier on Tuesday showed that the continent's composite data - a mix of both services and manufacturing - hit 53.1 in June, up from the flash estimate of 52.8, but unchanged from the previous month's reading.

Faster manufacturing growth was countered by a slowdown in the service sector, leaving the overall pace of expansion of business activity unchanged since May. The eurozone services PMI dropped to 52.8 in June from 53.3 the previous month, although this was higher than an initial estimate of 52.4. Eurozone Markit manufacturing PMI released last week climbed to 52.8 from May's 51.5, higher than the earlier flash reading of 52.6. Further, consumer prices in the Eurozone rose just 0.1 percent in June, official data showed last Thursday.

It is worth mentioning that the majority of the survey was completed before Britain voted to leave the EU on June 23, suggesting things could get substantially worse when the next reading comes in next month.

"The lack of any sign that the upturn is picking up speed will worry policymakers, especially as 'Brexit' uncertainty looks likely to subdue growth in coming months," said Markit's chief economist Chris Williamson.

Among eurozone countries, France slipped back into contraction in June with a services reading of 49.9 and hence composite of 49.6, but Germany's solid growth continued with 53.7 services and 54.4 composite both beating expectations. Upturns gathered pace in both Italy and Spain. Meanwhile, the currency bloc’s economy grew 0.6 percent in the first three months of the year, but the pace is expected to have weakened in the next quarter (April-June).

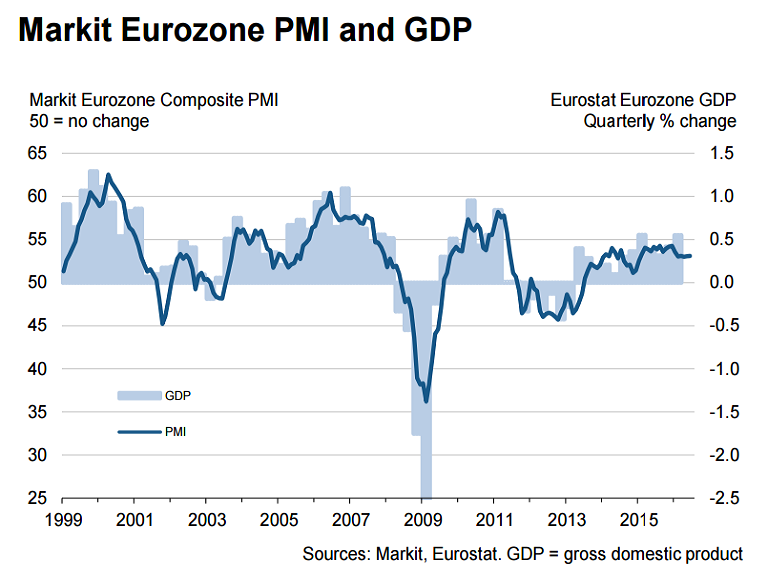

"The survey is signalling GDP growth of just 0.3%, similar to the sluggish trend recorded over the past year. The data suggest that the strong upturn seen in the official GDP data at the start of the year will have overstated the underlying health of the economy and that growth will have slowed in the second quarter," adds Williamson.

The Euro was slightly weaker following the data in choppy trading, while German bunds moved further into positive territory, while the Eurostoxx index was down by over 1% with a more cautious attitude towards risk. EUR/USD was trading at 1.1158 at 1130 GMT.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off