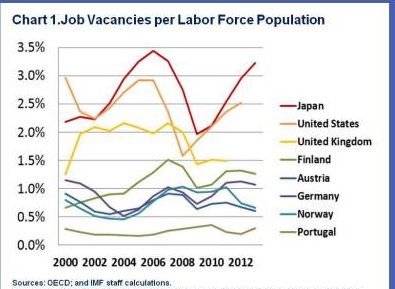

The chart from IMF reveals Europe's chronic problem, especially for the countries in Euro Zone. The chart shows job vacancies per labor force population. While the ratio remains high for Japan (+3%), US (+2.5%), for Euro zone countries it is just around 1% or below.

Euro zone really needs to improve its employment scenario by creating more jobs.

European Central Bank (ECB) is already pushing record easing by purchasing about €60 billion per month of asset purchase in a bid to boost inflation.

But the last thing Euro zone need is Asset price inflation thanks to easy monetary policies, what is required is demand driven inflation, which can hardly be achieved without maximum employment. Current ECB mandate doesn't include employment but it is expected to ease financial condition such that to boost growth and employment.

However, while loose monetary policy is keeping the conditions in place for employment and growth improvement, it clearly needs support of fiscal policy. Politicians in Europe, needs to go beyond poll friendly shorter term policies to growth and employment driven longer ones.

Unless Euro zone's tight labor market loosens Euro zone unlikely to realize its true potential.

With unemplyement hovering around 11%, it may not be wise to expect social stability.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings