Since European Central Bank (ECB) disappointed in December, sentiment started deteriorating in Euro zone. New Year turmoil across global stock market increased the tempo of deterioration.

- European Central Bank (ECB) again gave assurance to act in March further and keep policy very accommodative for very long and that might boost sentiment from March.

- Concern over immediate hard landing in China and weakness in emerging markets likely to weigh on sentiment, however comments from this weekend's G20 finance ministers' meeting might improve business sentiment.

- Business prospect is however great with weaker Euro improving competitiveness of Euro area however domestic economies are facing some loss of momentum.

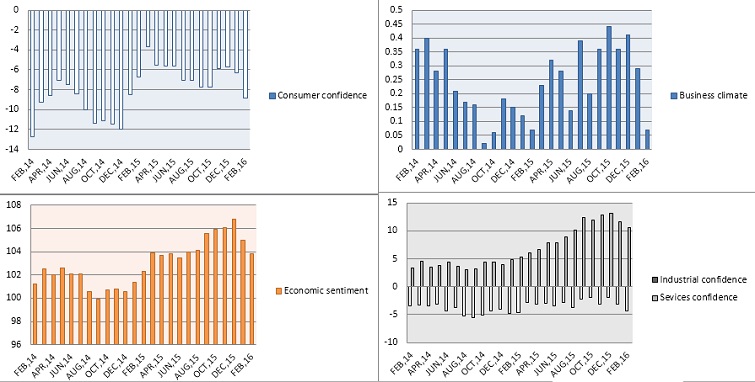

Today's economic survey showed that sentiment across Euro zone dropped sharply.

- Euro zone business climate dropped to 0.07 in February, lowest reading since February, 2015.

- Industrial confidence dropped to -4.4 lowest since February, 2015. Economic sentiment soured to 103.8, worst reading since May, 2015.

- Services sentiment dropped drastically to 10.6, lowest reading since August, 2015.

- Consumer confidence dropped to -8.8, worst reading since December, 2014.

Euro is currently trading at 1.102 against Dollar.

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom