Euro is back falling against Dollar, however it would be premature to assume that Euro down trend is back, after Thursday's violent surge.

After shunning European bonds on Thursday, investors are back pumping some money back into the bonds. Friday's payroll data ensured that US Federal Reserve policymakers will be in comfortable positions to hike rates if they want to. FED chair Janet Yellen's commentaries last week suggest, it is most likely that a raise is coming at next meeting.

Dollar is strong over the board, as investors jumped into weaker Dollar o bet a hike as movement upside after the FED action is expected. Nevertheless, due to heavy one sided bets, there are significant risks that there could be large profit bookings, enough to rattle markets in December's thin volume.

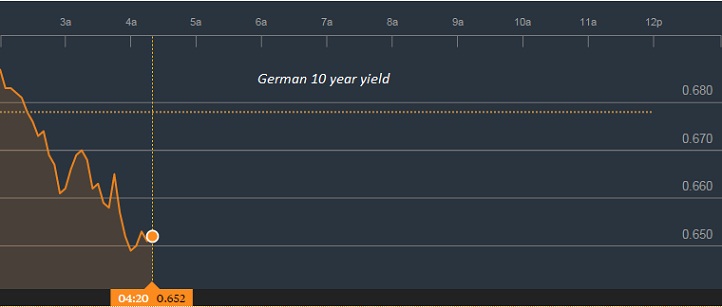

Euro is falling on the back of dropping bond yield, increasing the yield divergence between Dollar and Euro. German 10 year bund, is down to 0.65% from high of 0.68%, while 2 year yield is down close to 2%.

Euro is currently trading at 1.082 against Dollar.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed