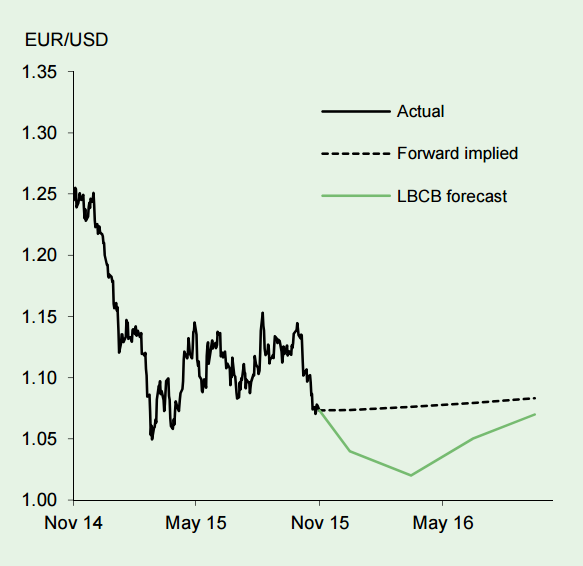

Having reached a recent high of around 1.15 in mid-October, EUR/USD has fallen sharply over the past month, hitting a low below 1.0650. Conflicting news on US and euro area monetary policy have pulled the euro and the US dollar in opposing directions. In the US, the surprise strength of the October employment report has been seized upon as sufficient grounds for the Fed to raise interest rates next month for the first time since June 2006.

At the same time, the ECB has hinted that further policy stimulus (both QE and a policy rate cut) may be on the cards when it revisits its growth and inflation forecasts next month. Although financial markets are now broadly priced to both these outcomes, it is believed that the prospect of heightened ECB/Fed policy divergence leaves the euro vulnerable to further downside over the coming months.

"We target a move in EUR/USD to 1.04 by end year and to 1.02 by end March, but a move below parity cannot be ruled out. Thereafter, we are constructive on the euro on fundamental grounds, but amid rising US interest rates, the prospect of any significant euro recovery through 2016 is, we believe, limited. We target a rise back to 1.10 by the end of next year", notes Lloyds Bank.

EUR/USD Outlook

Tuesday, November 17, 2015 10:09 PM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed