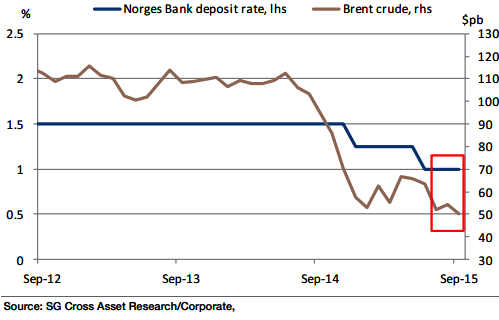

Falling oil prices and deceleration of inflation brings the possibility of another rate cut by Norges Bank this month. The NOK is among the cheapest currencies in REER terms but until oil prices stabilise, it is too soon to call the bottom.

"EUR/NOK traded over 9.50 in August to an eight-month high (9.5563), but a rise to 10.0 is not impossible if crude oil prices keep sliding towards the post-Lehman lows of $36.20 (Brent)", says Societe Generale.

Norway's CPI inflation fell to 1.8% yoy in July from 2.6% in June, the lowest in over a year. Underlying inflation UND1X slowed to 2.6% from3.2%. Q2 mainland GDP growth slowed to 0.2%, but including oil platforms, GDP shrank 0.1% qoq.

EUR/NOK set to test 10.0?

Friday, September 4, 2015 3:50 AM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022