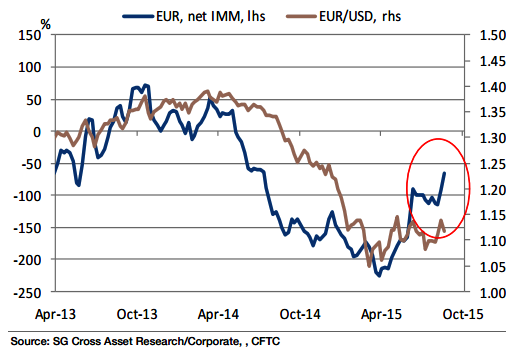

The EUR attracted strong support after the devaluation of the CNY and the selloff in equity markets. In trade weighted terms, the euro is up over 3% over the past month. The current account surplus (2.3% of GDP) is a stabilising factor.

"EUR/USD escaped the narrow trading range last month, scaling a 1.1714 high on 24 August. Short IMM positions have been cut to the lowest level in over a year. The biggest EUR gains have come against the commodity currencies, but a Fed rate hike should trigger EUR/USD profit taking", says Societe Generale.

The ECB revised down its inflation forecasts at the 3 September meeting to reflect lower oil prices, and hinted at possible expansion of QE. It raised the share limit of bond purchases from 25% to 33%. The 2015inflation forecast was lowered from 0.3% to 0.1%, 2016 CPI was cut from 1.5% to 1.1% and 2017 CPI was lowered from 2.0% to 1.8%.

China and risk aversion lift Euro

Friday, September 4, 2015 3:35 AM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed