Market focus in the coming week will be on the conclusion of the European Central Bank's (ECB) latest Governing Council meeting on Thursday, which also includes publication of the central bank's updated economic forecasts. No ECB policy change is expected but the bias that comes through in President Draghi’s press conference will be very closely examined.

Euro area economic surveys have pointed to a further strengthening and broadening of the recovery in the second quarter. The manufacturing PMIs indicate rapid output growth in the sector in the middle of Q2, with order books also continuing to grow strongly. Manufacturers were reportedly increasing their workforces at the fastest pace in the survey's twenty-year history. The final May services and composite PMIs from the euro area (due Tue) are also expected to confirm that the headline composite index was unchanged on the month at 56.8, consistent with GDP growth of 0.6-0.7 percent Q/Q.

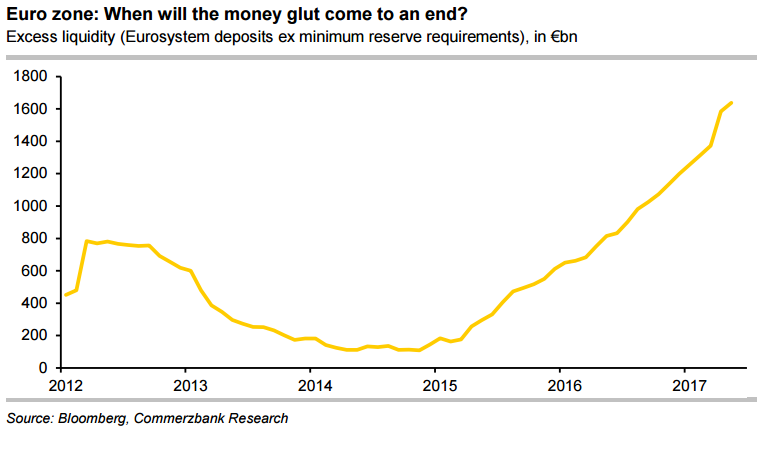

Eurozone inflation has failed to show any significant improvement over the recent months. Headline inflation in May came in at 1.4 percent, lower than at the March meeting and well below the 2.0 percent y/y target. Amid sharp seasonal swings, core inflation has remained roughly stable at 0.9 percent y/y in May, still in the “high deflationary risk area”. Also, the improvement in credit growth remains very gradual, up 2.2 percent y/y in May, roughly unchanged from the previous months. Amid waning inflation it is likely premature to expect a shift in ECB's tone toward teeing up an eventual exit path.

"We expect the ECB to leave its policy rates unchanged and to make no new announcements on its asset purchase programme, which is forecast to continue at €60bn a month until the end of the year," said Lloyds Bank in a report.

The ECB is expected to revise up its assessment of economic growth to "broadly balanced", but will reiterate that underlying inflation remains subdued. Inflation remains the anchor in the management of the monetary policy and with subdued inflation any change at the June meeting seems unlikely. However, there could be a chance to see a change in the wording of the forward guidance.

"We expect the ECB to drop the reference in the post-meeting statement that interest rates might yet be cut further and that the amount of monthly asset purchases might be increased. And while a formal announcement might not come until July, Draghi might also hint that the ECB will launch work at staff level over the summer to prepare options for the next steps of the QE programme once the currently planned asset purchases of EUR60bn per month up to year-end have been completed," said Daiwa Capital Markets in a report.

EUR/USD was trading rangebound on the day as markets remain cautious ahead of the crucial U.S. non-farm payroll data. The pair is consolidating after hitting 1.12566 and declined slightly till 1.12020 (21 4H EMA). Bullish continuation can be seen only above 1.12675. It is currently trading around 1.1220. On the lower side, any break below 1.1100 (23.6% retracement of 1.105694 and 1.12678) will drag the pair down till 1.1050/1.1000. The near term support is around 1.1180 (55-4H EMA)/1.1160.

FxWirePro's Hourly EUR Spot Index was at 80.4393 (Slightly bullish), while Hourly USD Spot Index was at -3.79302 (Neutral) at 1130 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks