Eurozone's economic growth will strengthen modestly in 2016 moving higher from this year. There might be an ease in consumer spending and exports growth, but a pick-up in business investment should balance this ease.

There is a cautious recovery in residential and public investment, which should lend further support and also there will be a modest growth in goverment spending. But the growth outlook will be wieghed on by EA's rising debt burden and rigidity in the structure.

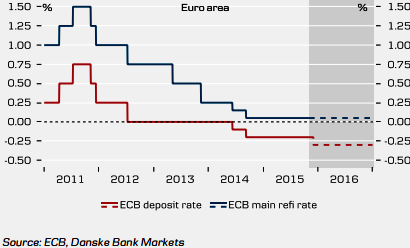

"ECB might likely implement deposit rate cuts, in line with other two rate cuts, with the first being the cut into negative territory. The risk is seen as skewed towards the ECB cutting the deposit rate more aggressively in an attempt to send a strong signal that it is committed to complying with its mandate of maintaining inflation below, but close to 2%", says Danske Bank.

A larger rate cut could be also seen as the ECB is looking at the experiences in other countries like Sweden, Denmark, e tc. The deposit cut is likely to be accompanied by a strengthening of the ECB's forward guidance.

ECB likely to cut the deposit rate by 10bp

Wednesday, November 4, 2015 7:15 AM UTC

Editor's Picks

- Market Data

Most Popular

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook