Euro area headline and core consumer prices due Wednesday are likely to show that the 19-region consumer prices stagnated in September for the first time in five months, according to a Bloomberg survey. Stalled prices would mark a setback for policy makers who have been trying to steer inflation back toward 2 pct, and may spark a new debate about deflation risks.

At his press conference a few weeks ago ECB President Draghi stirred speculation that the central bank could broaden its QE offering. Draghi acknowledged that while the central bank's 1.1 trillion euro ($1.2 trillion) asset-purchase program is working, the revival in inflation has been slower and weaker than initially anticipated. While ECB officials have repeatedly stressed that they're prepared to add stimulus if needed, they've also said they want more evidence before making a decision.

"On the back of diverging interest rate differentials we see scope for EUR/USD to trend towards 1.05 on a 12 month view", says Rabobank in a research note.

Low interest rates could lead the EUR to be used as a funding currency. But, carry trade is unlikely to regain significant momentum in the months ahead because of pressure on some EM currencies. Consequently it could be difficult for the ECB to succeed in pushing the Eurozone's effective exchange rate sharply lower.

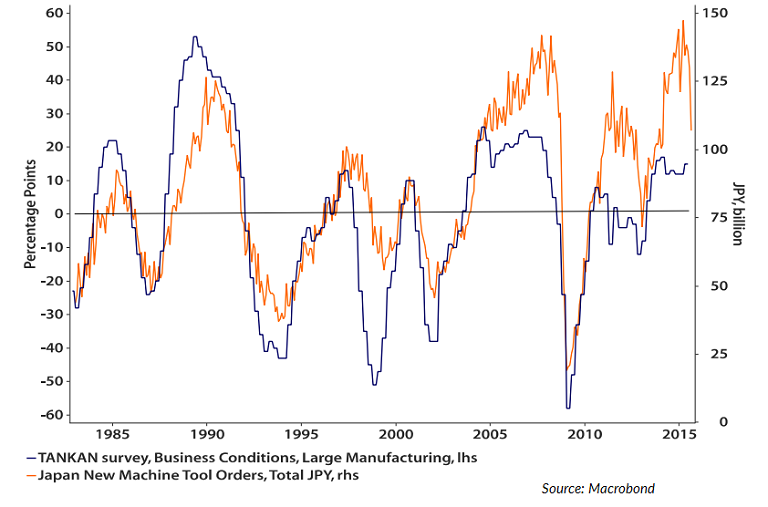

There is also a scope for the BoJ to increase its policy stimulation, despite the upbeat tone maintained by BoJ Governor Kuroda. Defaltionary pressures in Japan's economy were highlighted after the country's closely watched National CPI ex fresh food inflation measure registered -0.1% y/y in August. A positive "feedback loop", in which increases in jobs and wages lead to higher inflation, must strengthen further for Japan to see inflation hit 2 percent.

Kuroda today reiterated the central bank stands ready to expand monetary policy further if needed to achieve its 2 percent inflation target. He said that the central bank won't hesitate to adjust policy if needed to swiftly achieve price target and added that BoJ will maintain QQE for as long as needed to achieve 2 pct inflation target.

"The BoJ will take further policy action combined with our expectations of a Fed rate hike in December leads us to the view that USD/JPY can rise towards 123.00 on a 6 month view", notes Rabobank in a report to its clients.

With risk aversion at a heightened level in many EM markets, there will likely be lessened appetite to short the JPY to fund carry trades. This suggests that the BoJ, like the ECB, could struggle to push Japan's effective exchange rate much lower in the coming months which in turn suggests that the 2% CPI inflation target could remain elusive for some time.

The yen rose on Monday, gaining around 0.4 percent against the dollar and the euro, as a drop in global stock markets triggered a bout of safe-haven flows. The dollar was down 0.4 percent at 120.05 yen, while the euro, too was lower by a similar margin at 134.35 yen. The euro was down 0.1 percent against the dollar at $1.1184.

ECB and BoJ may struggle to push effective exchange rates sharply lower

Monday, September 28, 2015 11:22 AM UTC

Editor's Picks

- Market Data

Most Popular

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook