The fact that the Fed is looking to hike rates in the same month that the ECB is preparing to increase its stimulus could suggest opening of the floodgates for another drop in the value of EUR/USD. ECB President Mario Draghi in his speech on Friday announced the extension of the monetary policy's degree of expansion clearly. Astonishingly the EUR/USD exchange rate reacted only relatively moderately, suggesting that a certain degree of ECB extension was already priced into the EUR exchange rates.

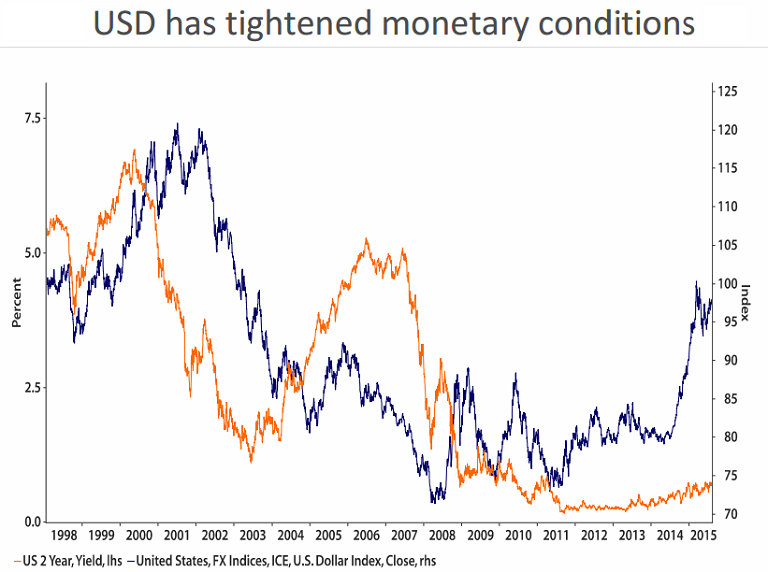

Also, over the past few sessions the Bloomberg spot USD index has dropped around 0.6% from its highs. This is despite the very clear message spelt out in this week's release of the FOMC's October minutes and in remarks by Fed ViceChair Fischer that the Fed is likely to tighten policy in December. This shows clearly that investors have begun to look beyond the December FOMC to the trajectory of Fed interest rates through 2016 and the message that the Fed is set to hike 'gradually' appears to be taking root.

In the 12 months to March 2015, EUR/USD fell by almost 14% and it is to be noticed that the build-up in long USD positions was one of the major facilitator in the downtrend. The fall could also be attributed to a dramatic softening in Eurozone monetary conditions during this period. However, in the current market scenario, with so much liquidity already in the system, there is a risk of a diminishing impact from additional ECB easing on market rates. Additionally, the market's enthusiasm for building up heavy long USD positions could be kept in check by the Fed and this could subdue downside potential for EUR/USD.

It is to be noted that unless US inflation indicators start producing upside surprises, the Fed may retain a cautious position with respect to policy tightening. This implies that the ECB may have to surprise markets in order to create some downside traction in EUR/USD over the next few months. Not only will a paring back of hawkish rhetoric from the Fed make the ECB's job tougher, but other central banks could take evasive easing action to prevent the ECB exporting its deflationary risks to them and this could prevent a significant broad based decline in the value of the EUR.

"We are of the view that EUR/USD will retain a downside bias. For now we are keeping parity in EUR/USD off and look for a move to 1.05 on a 3 month view. We will re-evaluate this position once the outcome of next month's ECB and Fed policy meetings is known", says Rabobank in a research note to its clients.

EUR/USD was trading at 1.0623 at 1053 GMT on Monday. Better-than-expected German and EZ PMIs released earlier today were largely ignored by the EUR bulls, who wait on the sidelines on fears of more ECB easing.

Downside traction in EUR/USD?

Monday, November 23, 2015 11:06 AM UTC

Editor's Picks

- Market Data

Most Popular

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target