Diversified Energy Company PLC (NYSE:DEC) is reportedly in advanced talks to acquire Maverick Natural Resources, a private equity-backed firm operating in the Permian Basin, in a deal valued at approximately $1.3 billion. If finalized, this acquisition would mark Diversified Energy’s largest purchase to date, according to the Wall Street Journal.

The potential deal underscores confidence in expanding U.S. energy production and aligns with recent policy shifts under former President Donald Trump. Last week, Trump declared a national energy emergency, emphasizing the need for increased domestic oil and gas production while rolling back climate-related restrictions imposed during the Biden administration.

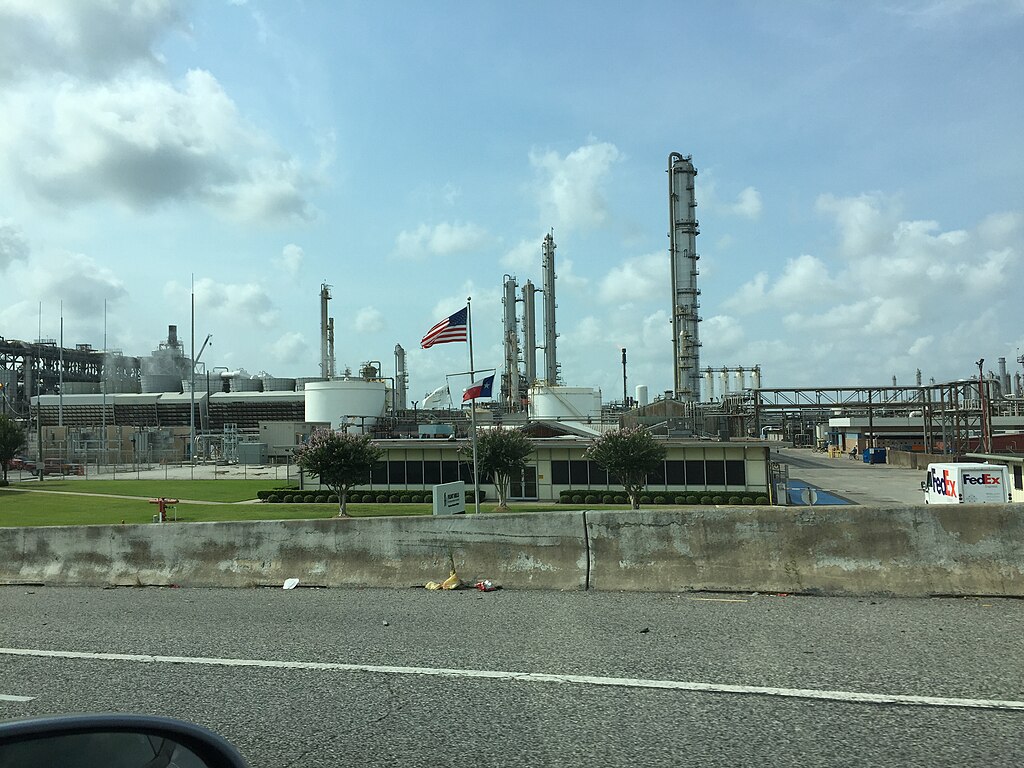

Maverick’s operations in the Permian Basin—a key oil-rich region in the southwestern United States—position Diversified Energy to capitalize on the basin’s status as the nation’s top oil-producing field. The Permian Basin is projected to produce 6.3 million barrels of oil per day in 2024, accounting for nearly half of total U.S. production.

This strategic acquisition highlights growing optimism in the energy sector amid expectations of fewer regulatory hurdles and rising demand for domestic energy resources. Diversified Energy’s expansion into the Permian Basin is seen as a pivotal move to strengthen its portfolio and solidify its presence in one of the world’s most prolific oil fields.

The deal, once completed, is expected to bolster Diversified Energy’s growth trajectory and reaffirm its commitment to leveraging high-yield assets in energy-rich regions. As the industry adapts to evolving market conditions, this acquisition positions Diversified Energy for long-term success.

By targeting strategic acquisitions and leveraging favorable market conditions, Diversified Energy continues to solidify its leadership in the energy sector.

Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links

Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links  TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment  Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate

Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate  Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine

Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine  SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off

SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off  OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering

OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering  Hims & Hers Halts Compounded Semaglutide Pill After FDA Warning

Hims & Hers Halts Compounded Semaglutide Pill After FDA Warning  Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies

Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies  Washington Post Publisher Will Lewis Steps Down After Layoffs

Washington Post Publisher Will Lewis Steps Down After Layoffs  Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape

Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape  Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports

Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports  Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil

Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil  Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge

Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge  Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million

Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million  American Airlines CEO to Meet Pilots Union Amid Storm Response and Financial Concerns

American Airlines CEO to Meet Pilots Union Amid Storm Response and Financial Concerns  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings