Bitcoin is a decentralized digital currency that enables instant payments to anyone, with no central authority. The Bitcoin network is secured by miners. Miners are specialized computers that use a consensus mechanism called “proof of work” to verify each block of bitcoin transactions. Miners are rewarded every time they successfully verify a block directly with BTC. Every 4 years this reward is halved, preset by code. The Bitcoin miner block reward will drop from 12.5btc to 6.25btc. At block 630,000 the block reward of mining a block on the Bitcoin network reduced from 12.5 BTC to 6.25 BTC completing its third successful halving. This fundamental event is perceived as quantitative measure as Bitcoin’s set supply cuts every 210,000 blocks are “all about the selling pressure” according to Mike. With miners having fewer coins to sell in the market (assuming miners do sell all their BTC) the supply will reduce as well.

Consequently, the underlying price of bitcoin has resumed its bullish business, BTCUSD surged 8,900 levels.

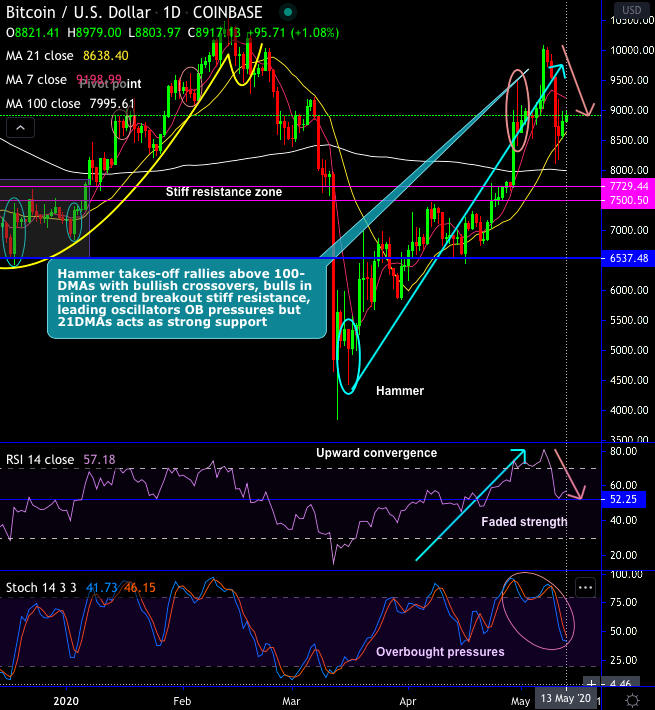

Technically, hammer takes-off rallies above 100-DMAs with bullish crossovers, bulls in minor trend breakout stiff resistance, leading oscillators OB pressures but 21DMAs acts as strong support. Since mid-March, BTC has spiked from $3,858 to the current $10,079 which is 160% rallies.

Accordingly, the long hedges have already been advocated using CME BTC Futures about 2-months ago. In addition, 1m ITM call options have also been recommended. These positions have been functioning as per our expectations so far, if we keep speculating on the next upside target and accumulate fresh bitcoins, it would be unwise. Instead, one can certainly uphold the above advocated long hedges for now.

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms