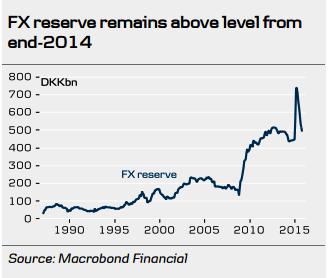

In October, Denmark's FX reserves declined to DKK492bn, from DKK514bn in September. DKK10bn of the decline was due to DN purchasing DKK in FX intervention.

The remainder was due to repayment of government foreign debt. Since April, DN has purchased DKK in FX intervention for DKK223bn, which has brought the FX reserve closer to the level from last year of around DKK450bn.

However, the pace of FX intervention slowed in October compared with September, where FX intervention totalled DKK22bn. The ECB is likely to cut its deposit rate by 10bp to minus 0.30% and expand its bond purchase programme to DKK75bn at its next meeting in December.

"DN might keep all its policy rates unchanged, i.e. the rate of interest on certificates of deposit is likely to stay at minus 0.75%, the current account rate at 0.00% and the lending rate at 0.05%", added Danske Bank.

Denmarks Nationalbank likely to stay on hold

Wednesday, November 4, 2015 4:04 AM UTC

Editor's Picks

- Market Data

Most Popular

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action