Dollar index trading at 96.15 (-0.09%).

Strength meter (today so far) - Euro +0.15%, Franc -0.30%, Yen -0.30%, GBP +0.67%

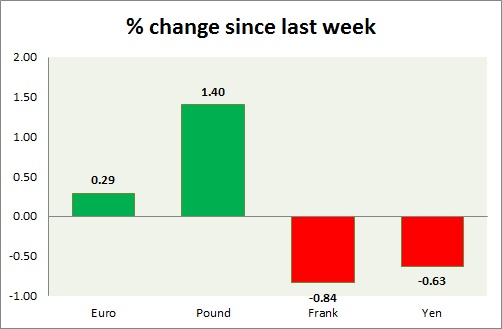

Strength meter (since last week) - Euro +0.29%, Franc -0.84%, Yen -0.63%, GBP +1.40%

EUR/USD -

Trading at 1.117

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range/Sell

Support

- Long term - 1.048-1.036, Medium term - 1.065-1.06, Short term - 1.08-1.085

Resistance -

- Long term - 1.175-1.18, Medium term - 1.14, Short term - 1.132, Immediate - 1.122

Economic release today -

- Euro Zone GDP rose by 0.4% q/q in second quarter, up 1.5% from a year ago

Commentary -

- Euro traded as high as 1.123 against Dollar, however failed to break key resistance around that price. Likely to move further down.

GBP/USD -

Trading at 1.538

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range/Sell

Support -

- Long term - 1.425-1.417, Medium term - 1.497-1.49, Short term - 1.518-1.512,

Resistance -

- Long term - 1.592-1.616, Medium term - 1.585, Short term - 1.543-1.545

Economic release today -

- NIL

Commentary -

- Pound is best performer today and this week so far. Amlin deal worth £ 3.5 billion provided some support. Active call - Sell Pound targeting 1.44 area with stop loss around 1.58 area.

USD/JPY -

Trading at 119.8

Trend meter -

- Long term - Buy, Medium term - Range/Buy, Short term - Range/Sell

Support -

- Long term - 113.7-112.9, Medium term - 115.7-115, Short term - 118

Resistance -

- Long term - 130, Medium term - 127.5, Short term - 124.5

Economic release today -

- Eco watchers survey for current deteriorated to 49.3 in August from 51.6 prior, outlook deteriorated to 48.2 in August from 51.9 in July.

- GDP contracted by -0.3% in second quarter, better than expected 0.5%.

Commentary -

- Yen lost ground as equities rose, consolidating around 120 level. Active call - Sell USD/JPY targeting 114.7 area with stop loss around 122

USD/CHF -

Trading at 0.98

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range/Buy

Support -

- Long term - 0.88, Medium term - 0.90, Short term - 0.93

Resistance -

- Long term - 1.174, Medium term - 1.025-1.02, Short term - 0.984-0.987

Economic release today -

- Swiss unemployment rate remained flat at 3.3% in August.

Commentary -

- Franc is the worst performer today as SNB keeps on selling Franc. Franc is the worst performer of the week.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate