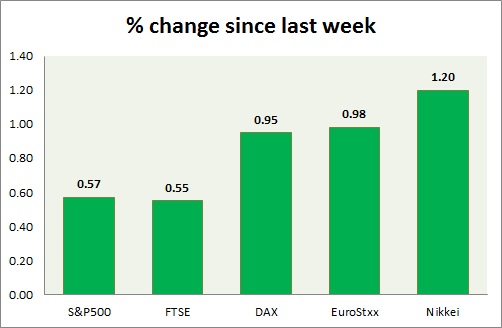

Equities are broadly in green today. Performance this week at a glance in chart & table

S&P 500

- S&P rose sharply, to trade as high as 1963, as risk aversion diminishes. Today's range 1932-1963

- S&P 500 future is currently trading at 1952. Immediate support lies at 1900 and resistance 2000.

FTSE

- FTSE is up today, riding on the Amlin deal. Today's range 6070-6200.

- FTSE is currently trading at 6150. Immediate support lies at 5950 and resistance 6600.

DAX

- DAX is up riding on subsiding risk aversion. Today's range 10090-10370.

- DAX is currently trading at 10270. Immediate support lies at, 9750 area and resistance at 10500 around.

EuroStxx50 -

- Stocks across Europe are green today.

- Germany is up (+1.6%), France's CAC40 is up (+1.1%), Italy's FTSE MIB is up (+1.3%), Portugal's PSI 20 is up (+0.95%), Spain's IBEX is up (+0.5%).

- EuroStxx50 is currently trading at 3230, up by +1.1% today. Support lies at 3000 and resistance at 3300.

Nikkei -

- Nikkei is the worst performer today as second quarter economic contraction by -0.3% is weighing on the index. Today's range 17360-18360

- Nikkei is currently trading at 17950, with support around 16000 and resistance at 19500.

S&P500

+1.46%

FTSE

+1.87%

DAX

+2.65%

EuroStxx50

+1.92%

Nikkei

+1.83%

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings