Dollar index trading at 95.64 (+0.38%)

Strength meter (today so far) - Aussie +0.38%, Kiwi +0.41%, Loonie +0.32%.

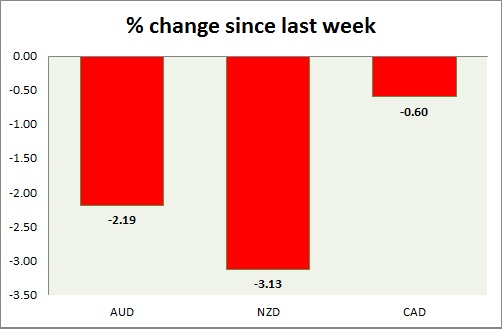

Strength meter (since last week) - Aussie -2.19%, Kiwi -3.13%, Loonie -0.60%.

AUD/USD -

Trading at 0.715

Trend meter -

- Long term - Sell, Medium term - Range, Short term - Range/Sell

Support -

- Long term - 0.60, Medium term - 0.70, Short term - 0.70

Resistance -

- Long term - 0.87, Medium term - 0.83, Short term - 0.78, Immediate - 0.74

Economic release today -

- Private capital expenditure dropped by -4% in second quarter

Commentary -

- Aussie is bouncing back today, with recovery in commodity prices. Active call - Sell Aussie with stop around 0.785 and 0.825 to target 0.715, 0.70 and 0.65.

NZD/USD -

Trading at 0.647

Trend meter -

- Long term - Sell, Medium term - Range/sell, Short term - Range/Sell

Support -

- Long term - 0.653, Medium term - 0.65, Short term - 0.65

Resistance -

- Long term - 0.78, Medium term - 0.75, Short term - 0.70, Immediate - 0.68

Economic release today -

- NIL

Commentary -

- Kiwi in for its next target around 0.56 against Dollar, with slowdown in China and further loosening of policy from RBNZ. Kiwi remains worst performer this week.

USD/CAD -

Trading at 1.326

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range/Buy

Support -

- Long term - 1.17, Medium term - 1.217, Short term - 1.29

Resistance -

- Long term - 1.40(broken), Medium term - 1.35, Short term - 1.35

Economic release today -

- NIL

Commentary -

- Loonie is the best performer this week as oil price drop slowed down. Oil price jumped back today supporting today.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate