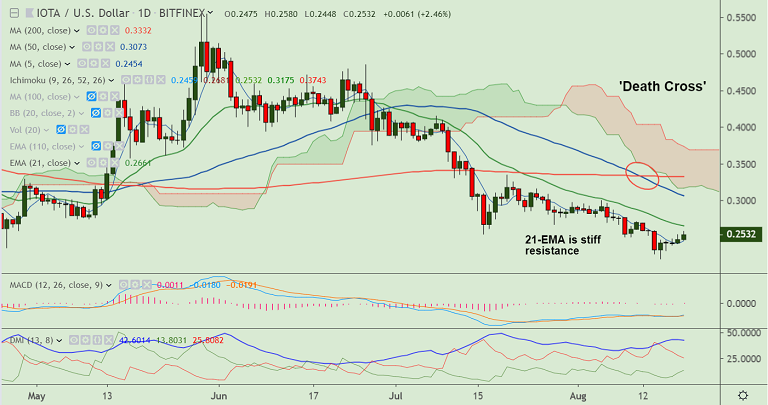

IOT/USD chart - Trading View

Exchange - Bitfinex

Support: 0.22 (Aug 15 low); Resistance: 0.2657 (21-EMA)

Technical Analysis: Intraday Bias turning slightly Bullish

IOT/USD was trading 2.32% higher on the day at 0.2529 at 10:50 GMT, intraday bias is turning bullish.

The pair is consolidating break above 200H SMA. Price action has broken above 55-EMA on 4H charts and 110-EMA on 2H charts.

Volatility is rising on the intraday charts raising scope for upside continuation.

That said, 'Death cross' (bearish 50-DMA crossover on 200-DMA' and stiff resistance at 21-EMA likely to keep upside limited.

Breakout at 21-EMA will see upside continuation. Scope then for test of 23.6% Fib at 0.2990.

Major trend is bearish. Rejection at 21-EMA will see downside resumption.