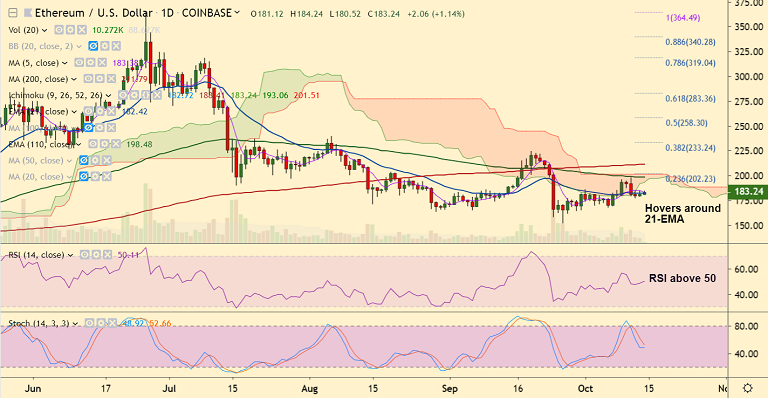

ETH/USD chart - Trading View

Exchange - Coinbase

Support: 178.70 (2H 200 SMA); Resistance: 198.48 (110-EMA)

Technical Analysis: Bias turning bullish (intraday)

ETH/USD trades marginally higher on the day at 183.36 at 08:30 GMT.

The pair is consolidating above 200H SMA and bias on the intraday charts is turning slightly bullish.

Downticks in the pair have held above 2H 200 SMA (178.70) and we see weakness only on break below.

RSI is holding above 50 mark and 'Bullish Divergence' on RSI and Stochs to support upside.

5-DMA is immediate resistance at 183.37, decisive break above to see further upside.

Next major hurdle lies at 110-EMA at 198.48 ahead of 23.6% Fib at 202.23.

On the flipside, 2H 200 SMA (178.70) is strong support, break below eyes 164.99 (Sept 6 low).