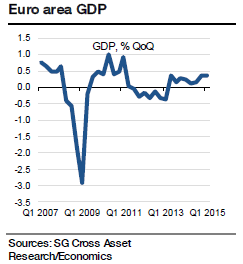

Seasonally adjusted GDP rose by 0.3% qoq in the euro area during the second quarter of 2015, after an increase by 0.4% qoq in Q1. For the second reading, no change has been expected and a confirmation of the 0.3% qoq growth. On the regional breakdown, Spain had the highest growth rate at 1.0% qoq, closely followed by Greece and Estonia at 0.8% qoq. Finland and France were the worst of the class with zero growth and -0.4% qoq, respectively.

"Looking below the surface, we expect the biggest contribution to GDP to stem from household consumption, up by 0.3% qoq, confirming our story of a domestic demand -led recovery. Government expenditure should also contribute positively, but the investment story should receive a whack after increasing three quarters in a row. The gross fixed capital investment is expected to experience zero growth qoq in Q2. The drag would mainly come from investment in construction. Net external trade is to have added 0.15pp of GDP, on the back of low imports", states Societe Generale.

Consumption and net exports to lead Euro area GDP in Q2

Tuesday, September 1, 2015 4:42 AM UTC

Editor's Picks

- Market Data

Most Popular

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal