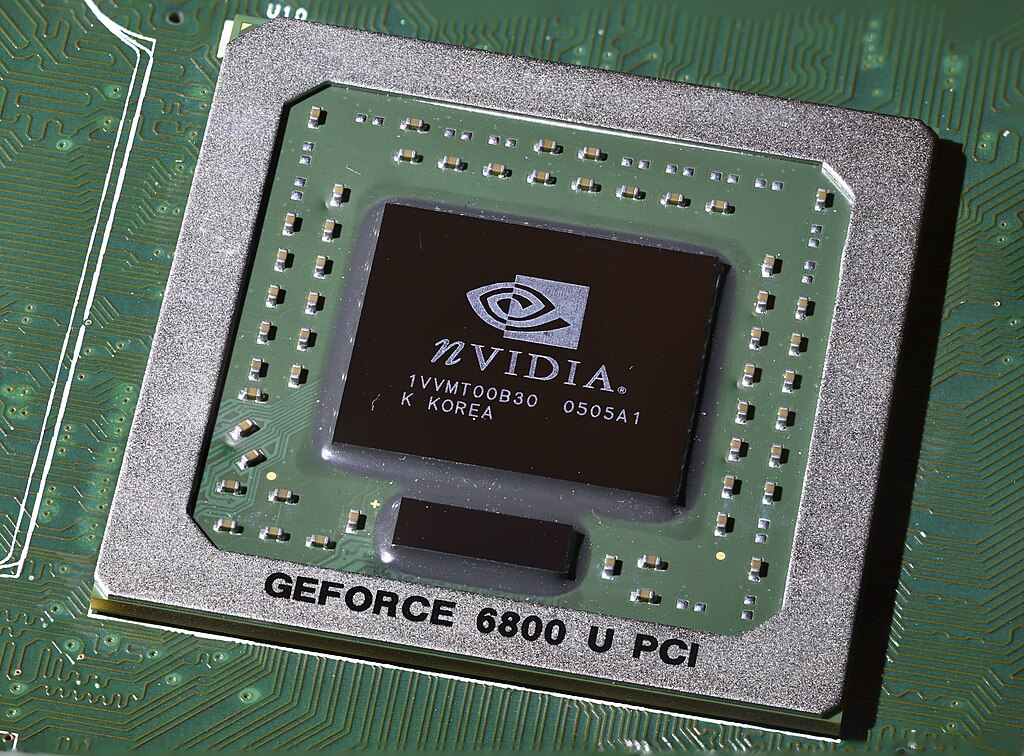

Chinese chipmaking stocks fell on Monday after reports surfaced that the Donald Trump administration was weighing whether to permit Nvidia to sell its advanced H200 artificial intelligence chip in China. The potential policy shift immediately stirred concerns among investors about increased competition for domestic semiconductor firms.

Semiconductor Manufacturing International Corp., China’s largest contract chipmaker, dropped as much as 7% in Hong Kong trading. AI chip designer Cambricon Technologies initially fell more than 2% before rebounding later in the session. Other major chip stocks moved unevenly, with Hua Hong Semiconductor sliding nearly 6%, while NAURA Technology Group gained about 2.6%. The broader Hang Seng chipmakers index edged down around 0.1%.

Market reaction was driven by a report released Friday indicating that U.S. officials were internally debating the possibility of approving Nvidia’s H200 chip for the Chinese market. The H200, launched two years ago, is considered significantly more powerful than the H20—currently the most advanced Nvidia AI chip legally sold in China. Although the H20 faced temporary export restrictions earlier this year, Washington later relaxed those limits as part of a broader trade agreement with Beijing.

Allowing H200 sales in China could reshape the competitive landscape. Analysts warn that access to a more capable Nvidia chip could shift demand away from Chinese chipmakers working to close the gap in AI processing technology. Such a move could also hinder Beijing’s long-term strategy to strengthen domestic self-sufficiency in semiconductors and artificial intelligence.

Despite the market’s reaction, reports emphasized that no immediate decision is expected. The discussions come at a time when U.S. lawmakers continue pushing for stricter limits on high-end chip exports. The bipartisan GAIN AI Act aims to require U.S. chipmakers to prioritize domestic buyers before receiving approval to supply China.

China, meanwhile, has criticized U.S. export controls and accelerated efforts to build a fully independent chip and AI ecosystem.

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns