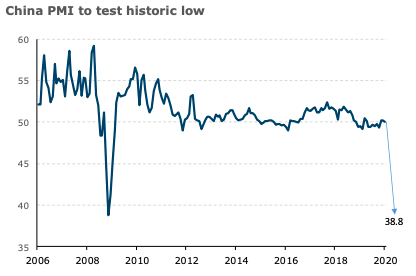

China’s manufacturing PMI for February is expected to hit an historic low of 38.8. The impact of the virus outbreak will see PMI drop further than the previous low in Q4 2008, according to the latest report from ANZ Research.

All high frequency trackers point to exceptionally low economic activity since the Lunar New Year. The high work resumption rate reported by the authorities does not represent capacity utilisation which is estimated to be about 20 percent of normal levels as of end February.

The biggest risk facing the economy is the breakdown of the liquidity chain. We estimate a shortfall of CNY2.6 trillion in cash flow in the corporate sector, the report added.

The virus outbreak has caused lack of cash revenue given the demand shock; mismatch of accounts receivable and payable; and insufficient cash to service loan and interest payments.

If the authorities cannot address the cash flow issue effectively, the outcome for bad loans, defaults, bankruptcy and employment will be severe, ANZ Research further noted.

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election